Billionaire Warren Buffett will certainly continue to be chairman of Berkshire Hathaway when vice chairman Greg Abel takes control of as chief executive officer to start 2026.

The board of supervisors at the cash-rich corporation elected Sunday to maintain the fabulous 94-year-old financier as head of the board, a choice most likely to eliminate capitalists stressed over Berkshire’s exceptional winning touch amidst toll shocks, economic chaos and a feasible economic downturn.

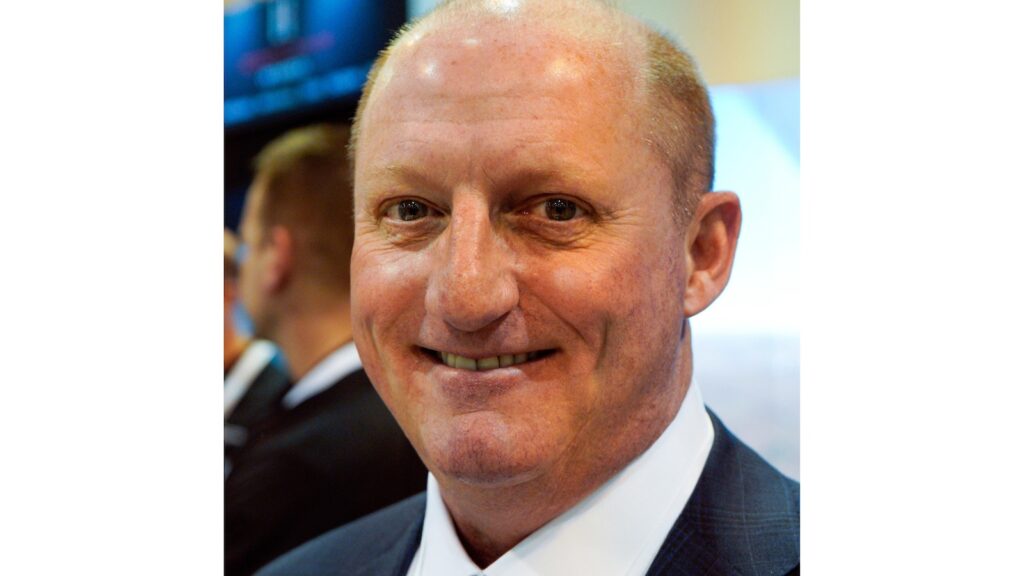

The board in the very same conference likewise accepted Buffett’s picked follower as chief executive officer, proficient Berkshire exec Greg Abel, 62. In a shock statement Saturday, Buffett stated he would certainly step down from that leading area by the end of the year.

In 6 years at the helm, Buffett transformed a Massachusetts fabric firm right into an expansive, however active corporation that has whatever from Daily Queen and See’s Sweets to BNSF Train and gigantic insurance companies. As the firm expanded, its supply commonly increased previous indexes by large margins– returning an ordinary 19.9% every year versus 10.4% for the Criterion && Poor’s 500.

The choice to proceed with the supposed Sage of Omaha as head of the board came amidst supposition that Howard Buffett, the second-born of the financier’s 3 youngsters, would certainly relocate right into that area. The older Buffett has actually stated that after he dies he would certainly such as Howard to take control of as chairman.

An existing vice-chairman, Abel, will certainly take control of as chief executive officer as large concerns float over the firm. Buffett himself has actually stated Head of state Donald Trump’s tolls were a large blunder. There are likewise frets that Berkshire could unable to prevent the destiny of a lot of corporations– required to separate to regain emphasis.

After That there is Berkshire’s $348 billion in cash money.

Buffett states he does not see numerous deals to spend that cash in currently, not also Berkshire’s very own supply, however ensured a few of the approximated 40,000 guests of the firm’s congratulatory weekend break yearly conference in Omaha, Nebraska, that day the firm would certainly be “pounded with chances.”

Abel, a subtle Canadian with a love a hockey, has actually been supervising a lot of Berkshire’s non-insurance companies for several years, however has actually not been making a decision where to spend the firm’s cash money.

Buffett stated his count on Abel can seen in where he is placing his cash.

” I have no objective– absolutely no– of marketing one share of Berkshire Hathaway. I will certainly offer it away ultimately,” Buffett stated. “The choice to maintain every share is a financial choice since I believe the leads of Berkshire will certainly be much better under Greg’s monitoring than mine.”

What to do with that said individual ton of money, virtually $170 billion, will become in the hands of Buffett’s 3 youngsters, consisting of prospective Berkshire chairman, Howard Buffett.

Howard was assigned in June together with his brother or sisters as supervisor of Buffett’s depend on when he passes away and he stated that they will certainly determine where to donate that cash. Buffett has actually currently handed out billions, a lot of significant more than $40 billion to the Gates Structure began by Costs and Melinda French Gates.

Howard, 70, has his very own structure whereby he has actually given away billions to altruistic and food protection triggers, consisting of aiding coffee ranches in El Salvador and clearing landmines in Ukraine.

Homages to Buffett came rolling in over the weekend break commending his financial investment savvy and modest monitoring design.

” There’s never ever been somebody like Warren, and many individuals, myself consisted of, have actually been motivated by his knowledge,” Apple chief executive officer Tim Chef published on X. “It’s been among the wonderful advantages of my life to understand him.”

JP Morgan’s chief executive officer Jamie Dimon stated Buffett stood for “whatever that is great regarding American industrialism and America itself,” and commended his “stability, positive outlook and sound judgment.”

____

AP Service author Bernard Condon remains in New York City City. AP Service Author Michelle Chapman added to this record from New york city City.

.