The Customer Financial Defense Bureau, an independent company developed following the 2008 economic situation to guard Americans versus unjust service techniques, is the most recent target of Elon Musk and the Trump management.

The company goes to an online grinding halt after Musk’s Division of Federal government Performance and Russell Vought, the leader of the White Home budget plan workplace and currently acting supervisor of the CFPB, took control.

They and legislative Republican politicians have actually implicated the company of overreach and not being politically responsible.

Interior e-mails gotten by ABC Information reveal Vought recommended the company’s head office in Washington will certainly be shut all week and informed workers, “Please do not execute any kind of job jobs.”

In an article on X Saturday evening, Vought stated the CFPB’s financing, which comes via the Federal Get, is “currently being shut off.”

Autonomous Sen. Elizabeth Warren, that assisted produce the CFBP, published a video clip on Monday “sounding the alarm system bell” on what the influence will certainly be if its gutted.

A sight of the Customer Financial Defense Bureau (CFPB) head office structure in Washington, Feb. 10, 2025.

Saul Loeb/AFP through Getty Photos

Warren highlighted what she stated the company provides for typical Americans, consisting of searching for fraudulence in repayment applications, actioning in if a financial institution attempts to retrieve your cars and truck and functioning to reduce bank card costs. She said that just Congress can take apart the CFPB, which Trump and Musk do not have the authority to do so unilaterally.

” So, why are these 2 men attempting to digestive tract the CFPB? It’s not brain surgery: Trump campaigned on assisting functioning individuals, today that he supervises, this is the payback to the abundant men that purchased his project and that wish to rip off households– and not have any person around to quit them. Yeah, it’s one more rip-off,” she stated.

Legislative Democrats and others opposed outside the company on Monday mid-day.

Right Here is what to learn about the company and its job.

What is the Customer Financial Defense Bureau?

The CFPB is an independent company developed by Congress after the 2008 economic situation under the Dodd-Frank Wall Surface Road Reform and Customer Defense Act. It’s a customer guard dog targeted at safeguarding American homes from unjust and misleading techniques throughout the economic solutions market.

Its oversight puts on every little thing from home loans to charge card to financial institution costs to trainee lendings. By legislation, the CFPB has the unusual capability to provide brand-new guidelines– and enforce penalties versus firms that damage them.

Because its facility in 2011, the CFPB states it has actually clawed back $20.7 billion for American customers.

Unlike several government companies that are beholden to appropriations fights in Congress, the CFPB’s financing comes via the Federal Get system. This has actually made it a constant target by Republicans and market teams. Last summer season, the High court ruled the CFPB’s resource of financing is constitutional.

Trick activities under the Biden management

Under the Biden management, the CFPB took hostile actions to tackle large gamers in the financial and economic solutions sectors– releasing laws that intended to place refund in the pockets of 10s of numerous Americans.

In December, it wrapped up a guideline that would certainly cover most financial institution overdraft account costs at $5 (now those costs can be as high as $35 per deal). The company stated that would certainly conserve the regular house $225 each year, or regarding $5 billion in total amount. That policy was readied to work October 1, 2025– yet its destiny is currently in limbo provided the job deduction order from acting supervisor Vought.

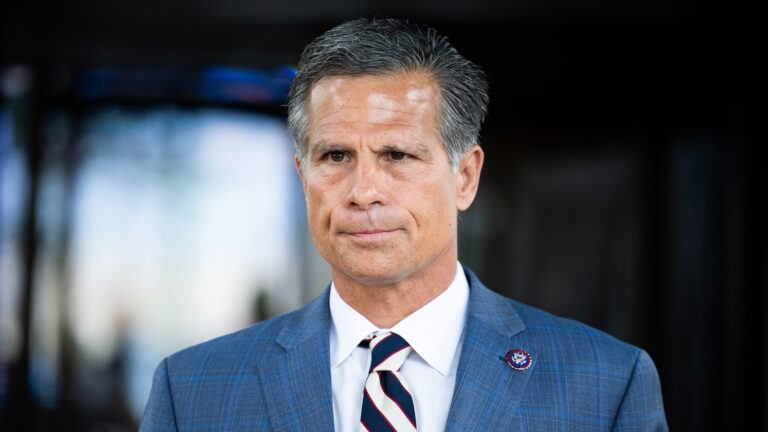

Russell Vought indicates prior to the Us senate Spending Plan Board on his election to be United States Supervisor of the Workplace of Administration and Spending Plan on Capitol Hillside in Washington, Jan. 22, 2025.

Saul Loeb/AFP through Getty Photos

The CFPB likewise wrapped up a guideline in January that would certainly clean clinical financial debt from Americans’ credit scores records. The company approximated that would certainly impact about 15 million Americans with $49 billion in overdue clinical expenses on their credit scores records. The adjustment, readied to work in March, is presently on hold as it deals with lawful obstacles. A comparable policy covering bank card late costs is likewise in lawful limbo.

Past releasing brand-new guidelines, the CFPB likewise resolves straight grievances from customers that may have been scammed on every little thing from charge card to cryptocurrency to auto loan.

Supervising home loans and financial institutions

The 2008 economic downturn revealed the amount of Americans were left susceptible in the uncontrolled subprime home mortgage market. Among the essential objectives of the CFPB was to manage the “nonbank home mortgage market.” Simply put, this puts on buyers that get home loans via independent loan providers that aren’t financial institutions.

According to the CFPB, nonbank loan providers represent 65% of all home loans in the united state in a market worth $13 trillion.

In technique, what this suggests is that the CFPB displays and maintains tabs on nonbank loan providers to attempt to guarantee they aren’t tricking or scamming clients.

The company likewise manages financial institutions and lending institution holding greater than $10 billion in properties, representing greater than 80% of the financial market’s complete properties. This consists of financial institutions like JPMorgan, Citigroup and Financial Institution of America. Various other government companies like the Fed, FDIC and Workplace of the Financial officer likewise manage financial institutions.