Prior to degenerating right into individual assaults, the clash in between Head of state Donald Trump and Elon Musk started with a dispute over the nation’s ballooning financial debt.

Musk openly condemned what Trump hopes will certainly be his trademark legal accomplishment– a large tax obligation and migration costs called the One Big Beautiful Expense Act– as an “plague” over its approximated influence on the deficiency and financial debt.

Comparable problem amongst a handful of Republican spending plan hawks in the Us senate is making complex the costs’s course to flow by Trump’s preferred 4th of July target date.

Gas was included in the fire when the detached Congressional Spending plan Workplace launched its brand-new rating approximating the regulation would certainly include $3 trillion to the public debt over the following years.

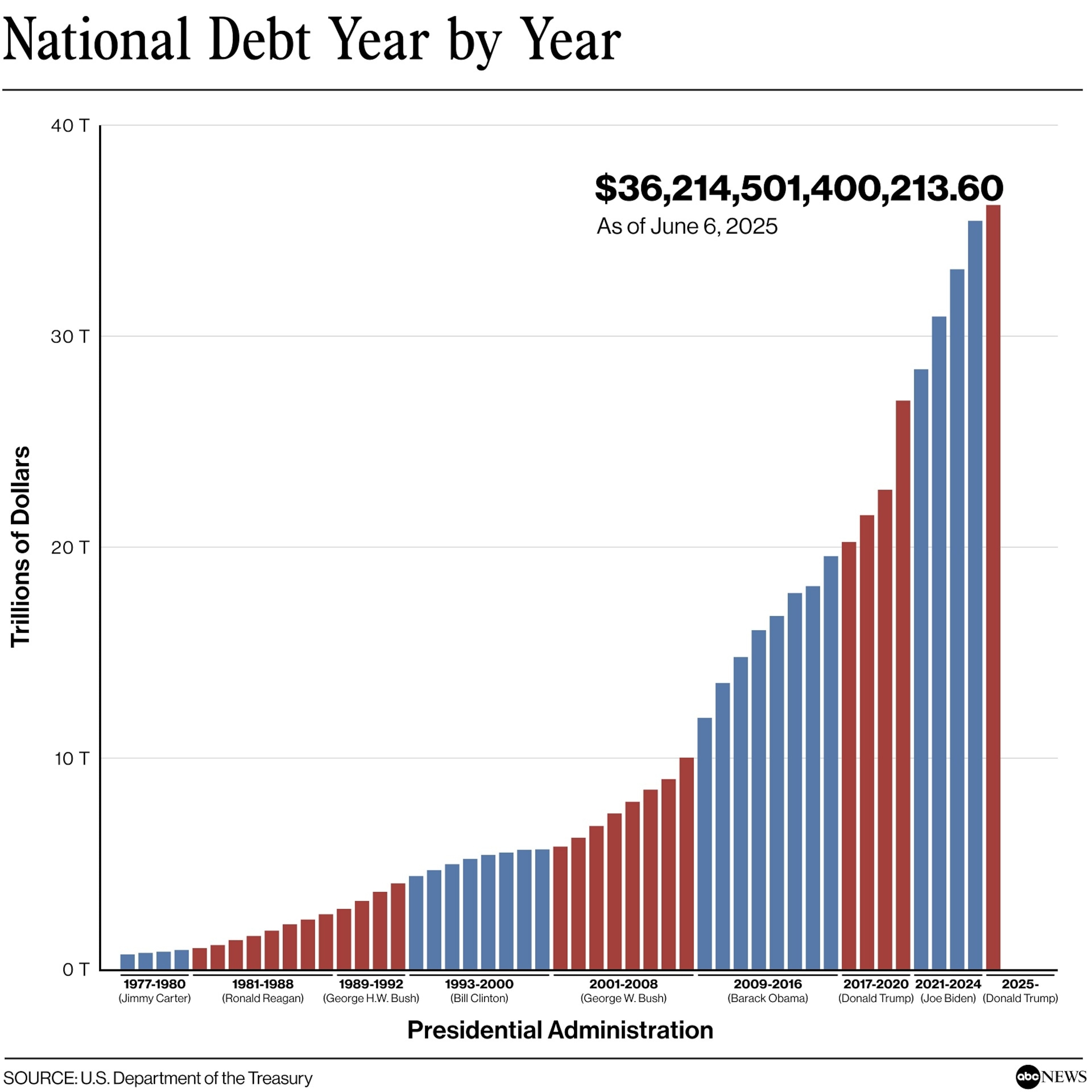

The financial debt– the total amount of yearly shortages and passion– stands at a historical high of $36 trillion. Openly held financial debt procedures at concerning 100% the dimension of the economic climate.

” We go to The second world war degrees now of national debt, and regarding the eye can see moving forward we’re simply climbing up,” Kent Smetters, a teacher at the College of Pennsylvania’s Wharton Institution of Company that previously operated at the CBO, informed ABC Information.

What to find out about the CBO rating of Trump’s megabill

The detached spending plan workplace approximated the Trump megabill as gone by your house would certainly include $2.4 trillion to the government deficiency over the following years, plus bring $550 billion in passion expenses.

” One Large Gorgeous Expense Act” approximated rises to the public debt

Legislative Budget Plan Workplace, United State Division of the Treasury

Republican Politician Sen. Ron Johnson, after the CBO launch, informed ABC Information Live: “I contradict $2 trillion-plus shortages regarding the eye can view as the brand-new typical.”

” I’m stressed concerning our youngsters and grandkids, the reality that we’re mortgaging their future. It is incorrect. It’s unethical,” Johnson stated.

The White Residence and Residence management assert the CBO quote is wrong. Authorities have actually charged the company of political prejudice and differ with the method it computes ball game without considering possible financial development, which it will certainly in a different evaluation later on this year.

Professionals state the objection is not legitimate. They keep in mind that the CBO is presently helmed by an authorities that offered in the George W. Shrub management which its quotes for this costs are stone’s throw off from independent versions from financial institutions or various other outdoors establishments.

” I believe they recognize on some degree that what they’re doing is not fiscally liable, therefore they’re attempting at fault the carrier for that message,” stated Stan Veuger, an elderly other in financial plan researches at the American Business Institute, a right-leaning brain trust.

Veuger and Brendan Battle each other, the elderly supervisor for government spending plan plan at the left-leaning Fixate Spending plan and Plan Priorities, additionally highlight the CBO rating is based upon the costs as composed– when the assumption is that particular costs and tax obligation arrangements Republican politicians state will certainly run out in a couple of years will likely be expanded, bringing the costs’s monetary price greater.

At The Same Time, the CBO approximates that the megabill can reduce tax obligations by $3.7 trillion and reduced costs by $1.2 trillion.

And Trump has actually proclaimed one more evaluation out today from spending plan workplace that stated his toll plan (which the head of state’s recommended can spend for several of his megabill concerns) that claims profits from tolls would certainly decrease the deficiency by $2.8 trillion. Though that quote presumes the tolls would certainly remain in location completely, while Trump’s changed on his plan several times and his several of his toll activities are being tested in court.

Just how the financial debt obtained so high, and what the repercussions can be

The public debt has actually fired up in current years under both Autonomous and Republican managements. Huge tax obligation cuts under Head of states Ronald Reagan, George W. Shrub and Trump caused shortages; as did stimulation bundles come on the wake of the 2008 economic situation and the 2020 coronavirus pandemic.

Public debt year by year

United State Division of the Treasury

To assist spend for Trump’s megabill, Republicans are making adjustments to Medicaid and the Supplemental Nourishment Aid Program. The detached spending plan workplace approximates countless Americans will certainly shed medical insurance as a result of the cuts.

” It’s something if we were asking Americans to type of offer a little to decrease the deficiency. However this does not decrease the deficiency,” stated Battle each other. “This raises the deficiency while leaving countless reduced and modest earnings repayments even worse off.”

Stabilizing spending plan sheets entirely would call for a lot more radical adjustments. All government costs would certainly require to be decreased 30% and tax obligations enhanced by 26%– or some mix of both– right away and for life, stated Penn Wharton’s Smetters.

While lots of financial experts think some national debt is an advantage, as it implies lots of check out united state protections as amongst the best properties on the planet, excessive financial debt can have adverse implications.

Professionals stated possible repercussions can be a rise to rates of interest and problems with the bond market. It can additionally bring about much less wage development and financial progression. A worst-case circumstance would certainly be back-pedaling financial debt.

” The USA is certainly not also huge to stop working,” Smetters stated. “When failing takes place, what you see is substantial rising cost of living, you see substantial discomfort and you see social turmoil.”