Tax obligation credit scores for tidy power and home power effectiveness would certainly still be eliminated, albeit much less rapidly, under Us senate Republicans’ most recent recommended modifications to a huge tax obligation costs. Electric lorry rewards and various other arrangements planned to relocate the USA far from nonrenewable fuel sources would certainly be gutted swiftly.

Us senate Republicans cast their variation of the costs as much less damaging to the tidy power market than the variation Home Republicans passed last month, however Democrats and supporters slammed it, claiming it would certainly still have substantial effects for wind, solar and various other tasks.

Inevitably, anywhere Congress winds up can have a huge influence on customers, firms and others that were relying on tax obligation credit scores for environment-friendly power financial investments. It can likewise influence long-lasting just how rapidly America shifts to renewable resources.

” They desire everyone to think that after the problematic Home costs, that they have actually generated a a lot more modest environment strategy,” stated Sen. Ron Wyden of Oregon, the leading Democrat on the money board, throughout a teleconference with press reporters Tuesday.

” The fact is, if the very early forecasts on the tidy power cuts are precise, the Us senate Republican politician costs does nearly 90%” as much damages as your home proposition, included Wyden, that authored tidy power tax obligation credit scores consisted of in the 2022 Inflation Reduction Act passed throughout previous Head of state Joe Biden’s term. “Allow’s not obtain as well major concerning this brand-new Us senate costs being a kinder, gentler strategy.”

The Edison Electric Institute, a profession organization standing for investor-owned electrical firms, released a declaration praising the Us senate proposition for consisting of “extra affordable timelines for eliminating power tax obligation credit scores.”

” These alterations are an action in the best instructions,” stated the declaration from Rub Vincent-Collawn, the institute’s acting president, including that the modifications equilibrium “service assurance with monetary duty.”

Whether every one of the modifications will certainly be established right into regulation isn’t clear yet. The Us senate can still customize its propositions prior to they most likely to a ballot. Any type of problems in the draft regulation will certainly need to be ironed out with your home as the GOP seeks to fast-track the costs for a ballot by Head of state Donald Trump’s impending 4th of July target.

Significantly, several Republicans in Congress have actually supported to safeguard the clean-energy credit scores, which have actually extremely profited Republican legislative areas. A record by the Atlas Public Policy study company located that 77% of organized investing on credit-eligible tasks remain in GOP-held Home areas.

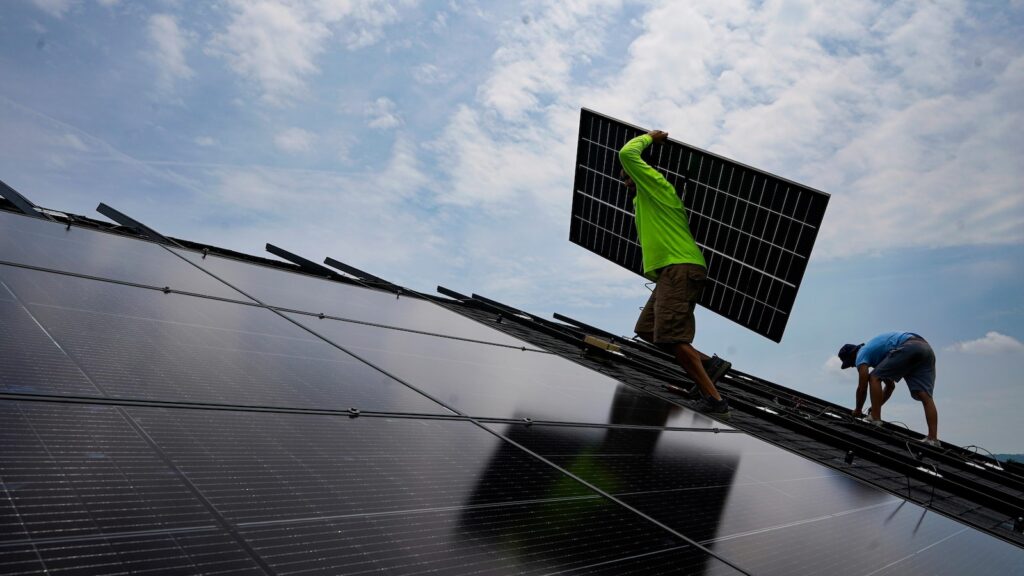

The tidy power tax obligation credit scores originate from Biden’s environment regulation, which intended to improve to the country’s change far from planet-warming greenhouse gas discharges and towards renewable resource such as wind and solar energy.

Your house variation of the costs took an ax to many of the credits and efficiently made it difficult for wind and solar carriers to satisfy the needs and timelines needed to receive the rewards. After your home ballot, 13 Home Republicans lobbied the Us senate to maintain a few of the tidy power rewards that GOP legislators had actually elected to eliminate.

Language consisted of Monday in the reconciliation bill from the Senate Finance Committee would certainly still terminate– though extra gradually than Home legislators visualized– some Biden-era green energy tax breaks.

The Us senate proposition additionally “accomplishes substantial financial savings by lowering Environment-friendly New Bargain investing and targeting waste, scams and misuse in investing programs while maintaining and safeguarding them for the most prone,” stated Sen. Mike Crapo, R-Idaho and chairman of the board.

On the slicing block are tax obligation credit scores for domestic roof solar installments, finishing within 180 days of flow, and an aid for hydrogen manufacturing. Federal credit scores for wind and solar would certainly have a longer phaseout than in your home variation, however it would certainly still be challenging for designers to satisfy the policies for starting building and construction in order to obtain the credit scores.

At the exact same time, it would certainly improve assistance for geothermal, nuclear and hydropower tasks that start building and construction by 2033.

” The costs will certainly remove the capability of countless American family members to pick the power financial savings, power strength, and power liberty that solar and storage space offer,” stated Abigail Ross Receptacle, head of state and chief executive officer of the Solar Power Industries Organization. “If this costs passes as is, we can not guarantee an inexpensive, trustworthy and safe and secure power system.”

Challengers of the Us senate’s message likewise decry residential production work and financial losses because of this.

” This is a 20-pound sledgehammer turned at tidy power. It would certainly indicate greater power costs, shed production tasks, shuttered manufacturing facilities, and an aggravating environment dilemma,” stated Jackie Wong, elderly vice head of state for environment and power at the Natural Resources Protection Council.

The costs would certainly likewise terminate rewards such as the Power Reliable Home Enhancement credit scores– which aids home owners make renovations such as insulation or cooling and heating systems that minimize their power use and power expenses– 180 days after implementation. A motivation for building contractors creating brand-new energy-efficient homes and apartment or condos would certainly finish one year after finalizing. Your house’s recommended end day for both is Dec. 31.

” Terminating these credit scores would certainly raise regular monthly expenses for American family members and services,” Steven Nadel, executive supervisor of the not-for-profit American Council for an Energy-Efficient Economic climate stated in a declaration.

The Us senate proposition goes up the timeline for finishing the customer electrical lorry tax obligation credit scores from completion of this year to 180 days after flow. It likewise reduces the stipulation that would certainly have prolonged up until completion of 2026 a credit score for car manufacturers that had actually not made 200,000 certifying EVs for united state sale. It would certainly likewise instantly remove the $7,500 credit scores for rented EVs.

This management has actually staunchly pursued EVs amidst Trump’s targeting of what he calls a “required,” inaccurately describing a Biden-era target for fifty percent of brand-new lorry sales by 2030 be electrical.

___

Associated Press authors Matthew Daly in Washington and Jennifer McDermott in Divine Superintendence, R.I., added to this tale.

___

The Associated Press’ environment and ecological insurance coverage obtains financial backing from numerous personal structures. AP is entirely in charge of all material. Discover AP’s standards for dealing with philanthropies, a checklist of advocates and moneyed insurance coverage locations at AP.org.