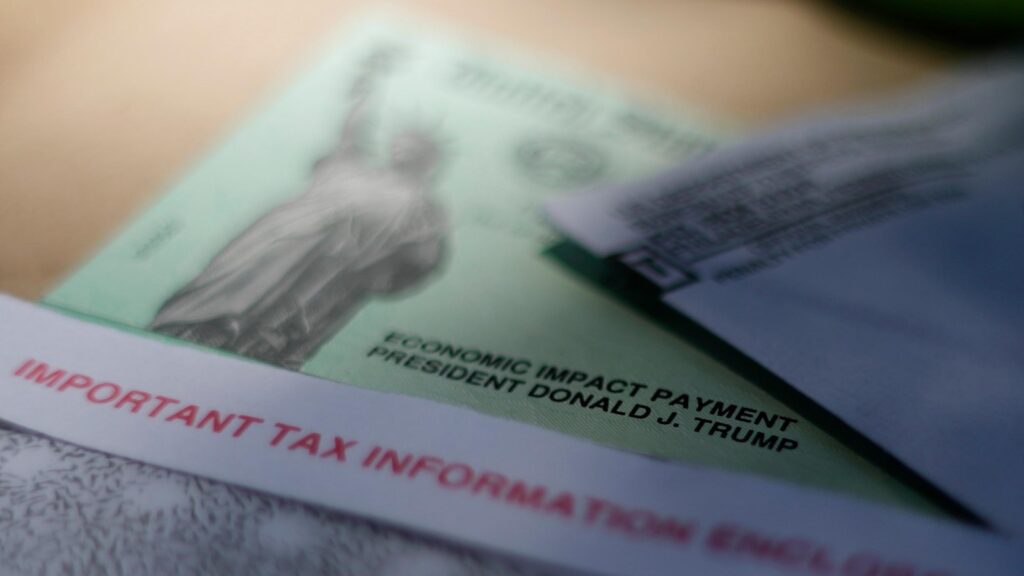

WASHINGTON– The united state federal government begins terminating paper checks for a lot of programs on Tuesday.

The adjustment, which was started with an exec order authorized by Head of state Donald Trump in March, will certainly impact receivers of advantages consisting of Social Security, Supplemental Safety Earnings and tax obligation reimbursements.

Trump’s Republican politician management says the change of all settlements and collections to digital approaches is made to secure taxpayers from fraudulence and swiped checks, accelerate handling and cut expenses. However supporters are afraid that the change will certainly injure marginalized Americans that do not have accessibility to electronic solutions and might not also understand this phase-out is coming.

” A great deal of complaintants move and do not constantly obtain their mail,” claims Jennifer Burdick, a local overseeing lawyer in the SSI System at Area Legal Provider in Philly. “And the individuals that I represent that obtain paper checks primarily gained from me regarding this change.”

About 10% of Burdick’s customers obtain paper checks. She frets that brand-new receivers that require a paper check to open up a bank account at a financial institution will certainly discover it challenging or perhaps virtually difficult to obtain that done after the phase-out.

Almost 400,000 Social Security and SSI recipients obtain their advantages with paper checks. That totals up to much less than 1% of the 70.6 million retired people, impaired individuals and youngsters that obtain Social Safety advantages.

As opposed to paper checks, they will certainly obtain a straight down payment or a Direct Express card, which is planned for individuals without a savings account. Nevertheless, the Social Safety Management claims it will certainly still release paper checks if nothing else choices are offered.

” Where a recipient has nothing else ways to obtain settlement, we will certainly remain to release paper checks,” the SSA claims.

Kathleen Romig, the supervisor of Social Safety and handicap plan at the Fixate Spending Plan and Plan Priorities, keeps in mind that individuals most impacted by this adjustment have a tendency to be one of the most at risk, “frequently unbanked or unhoused, and doing not have in the devices and abilities they require to gain access to electronic solutions.” There are factors they have not made the button yet– some individuals’s psychological wellness dilemmas make them skeptical of banks, and others merely do not have sufficient cash to open up a savings account.

” This is a populace that can not pay for to miss out on a settlement, so it’s extremely crucial that the Trump management handle the change without disrupting their advantages,” Romig claimed.

Nancy Altman, head of state of Social Safety Functions, a campaigning for team for the conservation of Social Safety advantages, calls the phase-out of paper checks unneeded.

” If it’s not managed right, it will certainly be ravaging” for individuals that are not aware of the adjustment and have actually restricted earnings, Altman claimed. “I believe anybody ought to have the ability to obtain a paper check. And while much less than 1% is obtaining a check, that’s still a great deal of individuals.”