LONDON– Britain’s High court on Wednesday subdued the sentences of 2 economic market investors charged of adjusting benchmark rate of interest in among the largest rumors to find out of the international financial crisis in 2008.

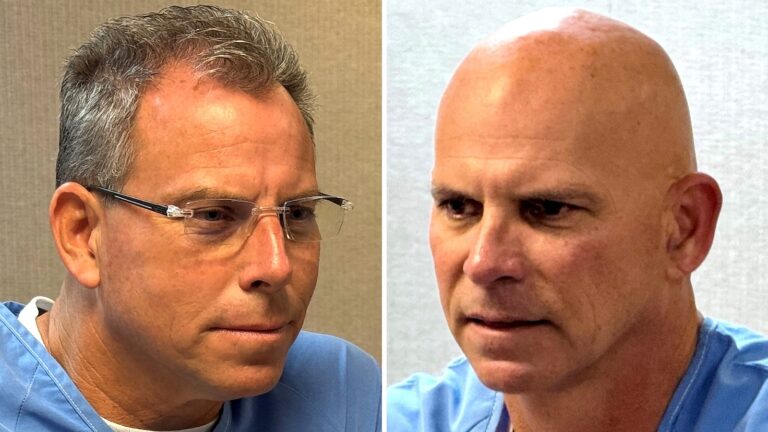

The costs versus Tom Hayes, a previous Citigroup and UBS investor, and Carlo Palombo, that helped Barclays, focused around claimed initiatives to affect the London Inter-Bank Offered Price, or Libor, and its euro money comparable Euribor, which were utilized to establish the rate of interest on trillions of bucks of car loans and various other economic items worldwide.

The court ruled that the convictions of Hayes and Palombo were unjust since the courts in their different situations provided incorrect guidelines to jurors. That successfully stopped jurors from thinking about the crucial concern of whether the investors had actually acted dishonestly.

” That misdirection weakened the justness of the test,” Court George Leggatt composed in an 82-page choice backed by all 5 participants of the panel that listened to the instance.

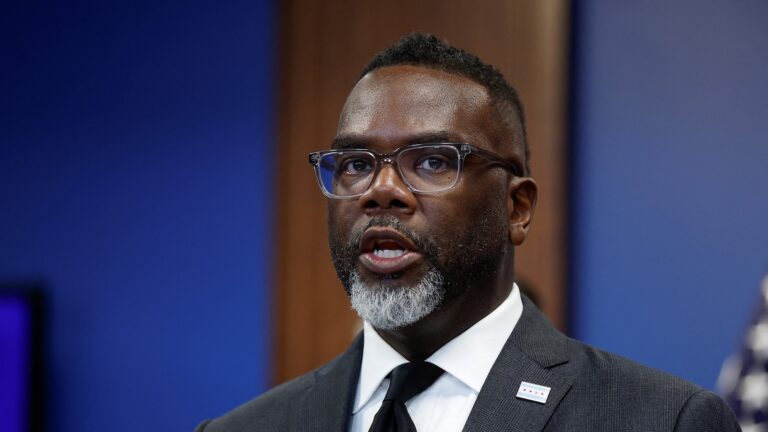

Hayes was founded guilty in August 2015 and punished to an optimum of 14 years behind bars, which was later on minimized to 11 years. Palombo, founded guilty in March 2019, was punished to 4 years behind bars. Both guys were launched in 2021.

” It damaged my household, I missed out on the majority of my boy’s childhood years,” Hayes informed the BBC.

” For as long I have actually been a worldwide fugitive … and currently I can proceed with my life, or attempt to,” he included.

The choice followed the united state Secondly Circuit Court of Charm in 2022 overturned the convictions of 2 investors billed with comparable criminal activities in the USA. Hayes and Palombo, whose charms were repetitively turned down by British courts, were permitted to take their instance to the U.K. High Court afterwards judgment.

The U.K.’s Serious Scams Workplace started examining claimed initiatives to control Libor in 2012. That inevitably caused the sentence of 9 lenders.

” We have actually considered this judgment and the complete scenarios thoroughly and established it would certainly not remain in the general public rate of interest for us to look for a retrial,” the SFO claimed in feedback to the High court judgment.

Libor and Euribor were important standards that were as soon as utilized to establish the rate of interest on every little thing from service car loans to home mortgages and charge card financial obligations. Because of this, they likewise came to be main to much more intricate economic deals such as those utilized by financial institutions and organizations to bank on rates of interest changes.

The standards were prone to control since they were established by financial institutions that can make money from swings in rate of interest.

Daily, significant global financial institutions were asked to send the rates of interest at which they can obtain cash from various other financial institutions. Approximately those entries was after that utilized to establish the everyday Libor and Euribor prices.

Throughout the economic dilemma, regulatory authorities realised that some financial institutions were making synthetically reduced Libor entries to make their establishments appear even more creditworthy. Some investors likewise looked for to affect the entries made by their financial institutions as also tiny relocate the criteria prices can enhance their revenues.

Those threats came to be a lot more obvious throughout the economic dilemma, when providing ran out and lenders needed to base their everyday entries on a subjective evaluation of the marketplace as opposed to real car loans.

Libor and Euribor were phased out recently, partly since they were viewed as getting worse the economic dilemma.