President Donald Trump’s plan for reciprocal tariffs on April 2 is predicted to be extra focused and narrower than what the president has vowed previously, however the plan remains to be below dialogue, sources informed ABC Information.

The contemporary spherical of duties, nonetheless, would nonetheless mark a major escalation for the U.S. and its buying and selling companions. In February, Trump ordered federal businesses to look into nearly each U.S. buying and selling companion in evaluating what reciprocal tariff charge to placed on them.

“April 2nd is Liberation Day in America!!!” Trump wrote on Reality Social. “For DECADES we’ve got been ripped off and abused by each nation within the World, each pal and foe. Now it’s lastly time for the Good Ol’ USA to get a few of that MONEY, and RESPECT, BACK. GOD BLESS AMERICA!!!”

Trump’s officers have been signaling a extra conciliatory tone in latest interviews.

“One of many issues we see from markets is that they’re anticipating … these actually massive tariffs on each single nation,” Kevin Hassett, Trump’s Nationwide Financial Council director, mentioned on Fox Information. “I feel markets want to vary their expectations, as a result of it’s not everyone that cheats us on commerce, it’s only a few nations and people nations are going to be seeing some tariffs.”

The administration is concentrated on buying and selling companions who’ve main commerce imbalances with the U.S., the sources mentioned.

“It’s 15% of the nations, nevertheless it’s an enormous quantity of our buying and selling quantity,” U.S. Secretary of Treasury Scott Bessent mentioned final week.

Final 12 months, in accordance with federal census information, the U.S. had the most important commerce deficits with China, the EU, Mexico, Vietnam, Taiwan, Japan, South Korea, Canada, India, Thailand, Switzerland, Malaysia, Indonesia, Cambodia and South Africa.

Bloomberg beforehand reported on the altered plans for tariffs. The Trump administration will doubtless forego sector-specific tariffs on autos, prescription drugs and semiconductors that have been additionally beforehand deliberate for April 2, The Wall Street Journal reported.

U.S. shares surged on Monday on the information of narrower tariff plans. The Dow Jones Industrial Common climbed practically 500 factors, or 1.2%, whereas the S&P 500 jumped 1.5%. The tech-heavy Nasdaq elevated greater than 2%.

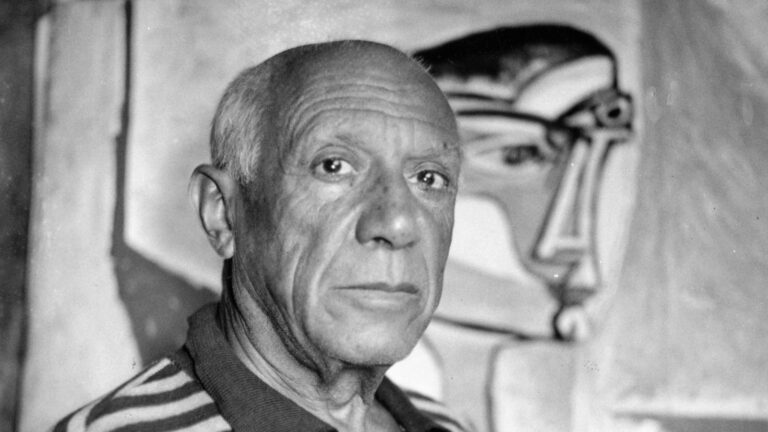

President Donald Trump appears to be like on throughout a cupboard assembly within the Cupboard Room of the White Home, Mar. 24, 2025, in Washington.

Brendan Smialowski/AFP by way of Getty Pictures

In latest weeks, Trump’s tariffs have roiled markets, stoked recession considerations and heightened worries about inflation. Briefly order, Trump has paused or reversed some tariffs, casting doubt over his plans and including to the uncertainty, specialists beforehand informed ABC Information.

The Trump administration earlier this month slapped 25% tariffs on items from Mexico and Canada, although the White Home quickly imposed a one-month delay for a few of these tariffs. A contemporary spherical of duties on Chinese language items doubled an preliminary set of tariffs positioned on China a month prior.

Tariffs imposed on metal and aluminum on March 12 triggered retaliatory tariffs from Canada and the European Union, including to countermeasures already initiated by China.

Economists extensively anticipate tariffs to extend inflation, since exporters sometimes cross alongside a share of the tax to customers within the type of value hikes.

Federal Reserve Chair Jerome Powell final week mentioned Trump’s tariffs are partly in charge for value will increase, leveling the criticism minutes after the central financial institution introduced its choice to carry rates of interest regular.

Even because the Fed left its fundamental coverage lever unchanged, the central financial institution predicted weaker year-end financial development and better inflation than it had in a December forecast.

ABC Information’ Max Zahn contributed to this report.