The securities market has actually gotten on a tear in current weeks, shaking off freshly enforced tolls, care at the Federal Get and battle between East.

The S&& P 500 has actually skyrocketed 20% considering that an April reduced experienced after Head of state Donald Trump’s “Freedom Day” toll news. Over that duration, the tech-heavy Nasdaq has actually climbed up 28%, while the Dow Jones Industrial Standard has actually leapt 12%.

Over the previous month– also as a U.S.-China profession stress resurfaced and the Iran battle burst out– the S&& P 500 climbed up greater than 5%.

Issue amongst financiers regarding chaotic financial plan has actually paved the way to mindful positive outlook regarding a dialed-back toll position and proceeded financial development, some experts informed ABC Information. While daily cost swings will likely continue, they included, the present overview indicate more gains over the rest of the year.

” The marketplace is making a rather collective initiative to attempt to look past several of these near term disturbances,” Yung-Yu Ma, primary financial investment planner at PNC Financial Providers, informed ABC Information.

In current weeks, Trump has actually curtailed several of his steepest levies, alleviating prices enforced upon firms and easing worry regarding a sharp rise of rising cost of living.

A profession contract last month in between the united state and China lowered tit-for-tat tolls in between the globe’s 2 biggest economic climates and activated a rise in the securities market. Within days, Wall surface Road companies softened their projections of a decline.

The downshift of tolls has actually accompanied information showing a healthy and balanced economic situation.

Fresh rising cost of living information previously this month revealed a mild velocity of cost rises, however rising cost of living stays near its least expensive degree considering that 2021. Employing reduced however continued to be durable in Might as the unpredictability bordering on-again, off-again tolls showed up to cut employing much less than some financial experts been afraid, a federal government record this month revealed.

The episode of tit-for-tat strikes in between Iran and Israel previously this month sent out supplies dropping and treked oil costs. Those difficulties confirmed brief, nevertheless, as supplies resumed their gains and oil costs reduced amidst a ceasefire.

” The securities market does not respect geopolitical occasions,” Ivan Feinseth, a market expert at Tigress Financial, informed ABC Information. “The marketplace could respond for a day or 2, however it was absolutely nothing continual.”

Financiers have actually additionally put hope in an anticipated decreasing of rate of interest at the Fed. Until now this year, the reserve bank has actually occupied a wait-and-see technique, holding rate of interest constant as policymakers wait for the prospective impacts of tolls. A current Fed projection recommended a most likely pivot, nevertheless, forecasting 2 quarter-point cuts this year in addition to 2 quarter-point cuts following year.

” The securities market’s current stamina mirrors expanding positive outlook around a soft touchdown, boosting company incomes and the capacity for reduced rate of interest in advance,” Brian Buetel, taking care of supervisor at UBS Riches Administration, stated in a declaration recently.

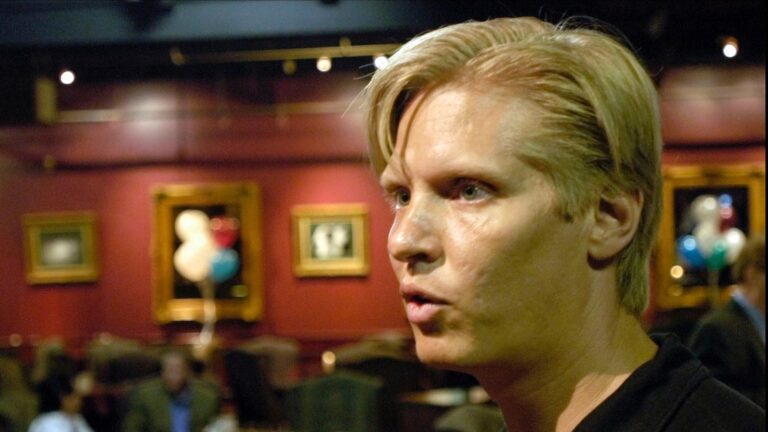

Investors work with the flooring at the New York Supply Exchange (NYSE) in New York City, June 25, 2025.

Jeenah Moon/Reuters

Still, the marketplace deals with significant threats, experts stated.

Profession stress might get worse and tolls might intensify, some experts stated, while keeping in mind the problem of preparing for specifically where the levies will certainly land. A resumption of hostilities between East might increase oil costs and hinder worldwide financial development, they included. A ruptured of tariff-induced rising cost of living might push the Fed towards a careful technique and hold-up prospective rates of interest cuts.

” In spite of the marketplace obtaining near its highs, obtaining also passionate is possibly not what’s required now,” Ma stated. “It’s still a back-and-forth market.”

However, experts anticipate a growth in the securities market over the rest of 2025. Feinseth anticipated an uptick in the S&& P from its present degree of 6,090 to 6,500, which would certainly note a rise of 6%. Ma anticipated comparable gains, claiming the marketplace would certainly increase a minimum of 5%.

” We assume the general end location is one that will certainly be tasty for markets,” Ma stated. “However it will certainly be a rough course from right here to there.”