BANGKOK– Supplies rallied Tuesday after united state Head Of State Donald Trump announced a ceasefire in the Israel-Iran problem, although the circumstance continued to be vague as assaults proceeded.

Trump stated Israel and Iran had actually accepted a “total and complete ceasefire” right after Iran introduced limited missile attacks Monday on a united state army base in Qatar, striking back for the American battle of its nuclear websites over the weekend break.

Unpredictability continued to be, with Israel not promptly validating any type of ceasefire. It was vague what the rocket launches would certainly provide for the ceasefire’s timeline.

Trump’s news on Fact Social stated the ceasefire would not start up until regarding twelve o’clock at night Tuesday, Eastern time. He stated it would certainly bring an “Authorities END” to the battle.

united state futures progressed, as agreements for the S&& P 500 and the Dow Jones Industrial Standard acquired 0.5%.

In Asia, Tokyo’s Nikkei 225 increased 1% to 38,756.00 and the Hang Seng in Hong Kong acquired 1.7% to 24,078.94.

The Shanghai Compound index climbed up 0.9% to 3,411.92.

In South Korea, the Kospi leapt 2.3% to 3,082.90, while Australia’s S&& P/ASX 200 acquired 0.9% to 8,551.40.

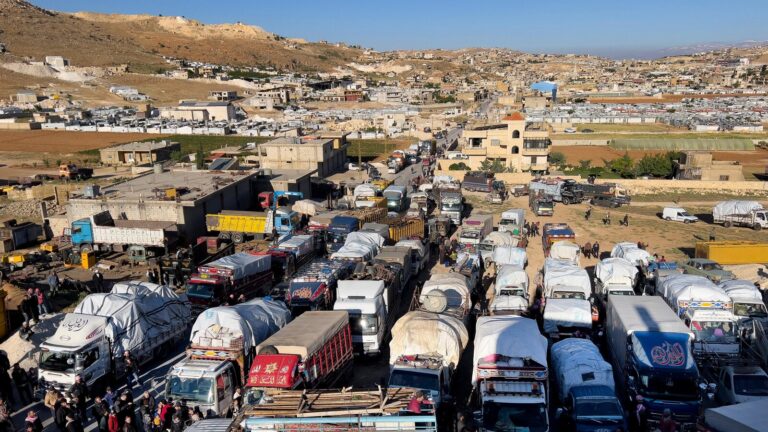

Oil rates dropped even more, after rolling on Monday as concerns went away of an Iranian clog of the Strait of Hormuz, an important river for delivery crude.

The rate of oil at first leapt 6% after trading started Sunday evening, a signal of climbing fears as capitalists obtained their initial opportunity to respond to the united state battles. However it promptly got rid of all those gains, with united state benchmark unrefined dropping 7.2%. It went down even more very early Tuesday, quiting 2.7% to $66.67 per barrel. It had briefly covered $78.

Brent crude, the global criterion, dropped 2.5% very early Tuesday to $69.68.

united state supplies rallied on Monday regardless of the USA’ bunker-busting entry right intoits war with Israel

The S&& P 500 climbed up 1% to 6,025.17 and the Dow industrials acquired 0.9% to 42,581.78. The Nasdaq composite index progressed 0.9% to 19,630.97.

That adhered to a week when supply rates had jumped up and down on stress over the problem possibly rising.

Iran’s revenge showed up not to target the circulation of oil. The concern throughout the Israel-Iran battle has actually been that it can press products, inflating rates for crude, gas and various other items.

Back in the united state, Treasury returns reduced after a top Federal Reserve official said she would support cutting prices at the Fed’s following conference, as long as “rising cost of living stress continue to be included.”

Financiers will certainly be expecting Fed. Chair Jerome Powell’s remarks to the united state Congress later on Tuesday, experts stated.

The return on the 10-year Treasury was up to 4.33% from 4.38% late Friday. The two-year Treasury return, which much more very closely tracks assumptions for the Fed, went down to 3.84% from 3.90%.

The Federal Get has actually been hesitant to cut interest rates this year due to the fact that it’s waiting to see just how much higher tariffs imposed by Trump will certainly injure the united state economic climate and increase rising cost of living.

Inflation has actually continued to be relatively tame lately, however greater oil and gas rates would certainly press it greater. That can maintain the Fed on hold due to the fact that cuts to prices can follower rising cost of living while they additionally provide the economic climate an increase.

On Wall Surface Road, Elon Musk’s Tesla was the solitary best pressure pressing the S&& P 500 greater after leaping 8.2%. The electric-vehicle firm started a trial run on Sunday of a tiny team of self-driving taxis in Austin, Texas. It’s something that Musk has long been touting and essential to Tesla’s supply rate being as high as it is.

Hims && Hers Wellness toppled 34.6% after Novo Nordisk stated it will certainly no more collaborate with the firm to market its preferred Wegovy excessive weight medicine. Novo Nordisk’s supply that sell the USA dropped 5.5%.

In money transactions very early Tuesday, the united state buck was up to 145.34 Japanese yen from 145.16 yen late Monday. The euro increased to $1.1604 from $1.1575.

___

AP Company Author Stan Choe added.

.