MCLEAN, Va.– The ordinary price on a 30-year united state home loan ticked up today, finishing a four-week slide that reduced loaning prices for property buyers to the most affordable degree in almost a year.

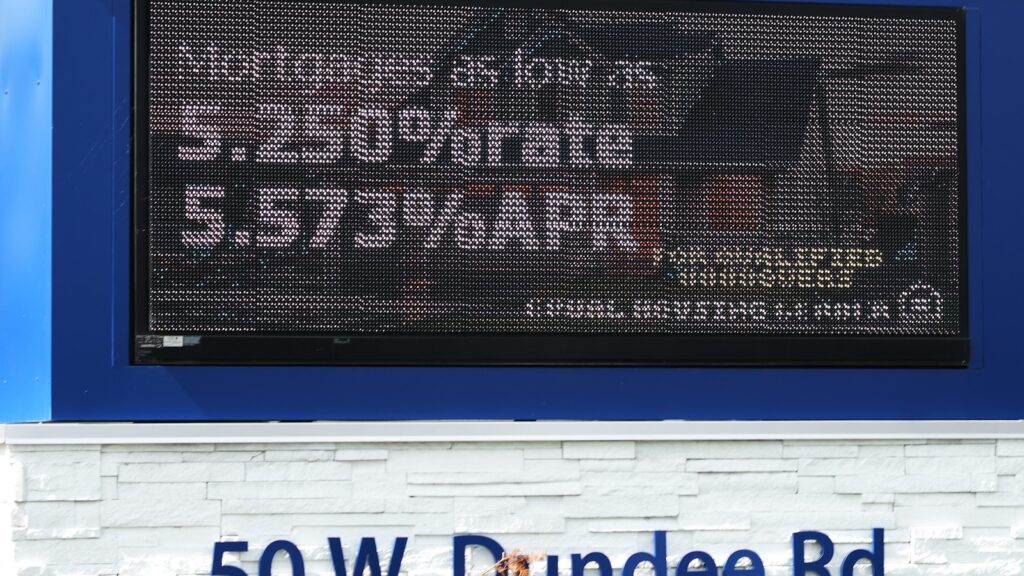

The price increased to 6.3% from 6.26% recently, home loan customer Freddie Mac claimed Thursday. A year earlier, the price balanced 6.08%.

Loaning prices on 15-year fixed-rate home loans, prominent with property owners re-financing their mortgage, additionally bordered greater. The ordinary price increased to 5.49% from 5.41% recently. A year earlier, it was 5.16%, Freddie Mac claimed.

Home loan prices are influenced by several factors, from the Federal Get’s rates of interest plan choices to bond market financiers’ assumptions for the economic climate and rising cost of living. They typically adhere to the trajectory of the 10-year Treasury return, which lending institutions make use of as an overview to rates mortgage. The return went to 4.19% in lunchtime trading Thursday, up from 4.16% late Wednesday.

Beginning in late July, home loan prices mainly decreased in the lead-up to the Federal Get’s commonly expected decision last week to reduce its major rates of interest for the very first time in a year in the middle of expanding issue over the united state work market.

The current descending fad bodes well for potential property buyers that have actually been kept back by stubbornly high home funding prices.

The real estate market has actually remained in a depression given that 2022, when home loan prices started climbing up from historical lows. Sales of previously occupied U.S. homes sank last year to their most affordable degree in almost thirty years. And, up until now this year, sales are running below where they were at this time in 2024.

Today’s surge in prices can indicate a repeat of what occurred concerning a year ago after the Fed reduced its benchmark price for the very first time in greater than 4 years. At that time, home loan prices succumbed to a number of weeks before the when the Fed cut prices at its September 2024 plan conference. In the weeks that complied with, nevertheless, home loan prices started climbing once again, ultimately getting to simply over 7% in mid-January.

Like in 2014, the Fed’s price cut does not always imply home loan prices will certainly maintain decreasing, also as the reserve bank signals much more cuts in advance.