BANGKOK– Oil rates resumed their higher climb and united state futures were lower very early Tuesday after Israel’s army provided an evacuation warning to 330,000 individuals in Iran’s funding Tehran.

Oriental shares were blended.

The emptying caution was for a component of Tehran, a city of 9.5 million, that houses the nation’s state television and police station and 3 huge medical facilities, consisting of one possessed by Iran’s paramilitary Revolutionary Guard. United State Head Of State Donald Trump introduced he was returning from the G7 top in Canada a day early because of the increasing dispute.

The futures for the S&& P 500 and the Dow Jones Industrial Standard were down 0.3%.

In Asia, Tokyo’s Nikkei 225 index climbing up 0.6% to 38,547.56 as the Japanese reserve bank decided to maintain its essential rate of interest unmodified at 0.5%.

The Financial Institution of Japan has actually been slowly elevating its price from near no and reducing on its acquisitions of Japanese federal government bonds and various other possessions to assist counter rising cost of living. It claimed financial development was most likely to modest and there was some weak point in customer view, real estate financial investment.

” Particularly, it is exceptionally unpredictable just how profession and plans in each territory will certainly advance and just how abroad task and rates will certainly respond to them,” the BOJ’s declaration claimed.

Chinese shares bordered lower. In Hong Kong, the Hang Seng slid 0.1% to 24,038.56. The Shanghai Compound index decreased 0.2% to 3,382.14.

In South Korea, the Kospi obtained 0.4% to 2,956.88.

Australia’s S&& P/ASX 500 quit 0.1% to 8,543.60. Taiwan’s Taiex obtained 0.6% and in Bangkok the collection was little bit altered.

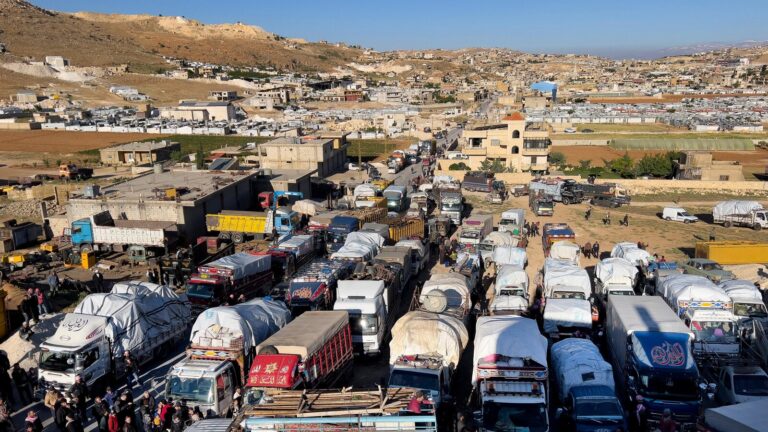

As Israel and Iran attack each other the concern continues to be that a bigger battle might restrict the circulation of Iran’s oil to its consumers. That subsequently might elevate fuel rates around the world and maintain them high, though spikes in rates from previous disputes have actually been quick.

Unrefined leapt 7% late recently afterIsrael’s attack on Iranian nuclear and military targets Very Early Tuesday, united state benchmark petroleum obtained 31 cents to $72.08 per barrel, while Brent crude, the worldwide requirement, was up 33 cents at $73.56 per barrel.

On Monday, the state of mind was tranquil on Wall surface Road, as the S&& P 500 climbed up 0.9% to redeem a lot of itsdrop from Friday It shut at 6,033.11. The Dow Jones Industrial Standard included 0.8% to 42,515.09, and the Nasdaq compound obtained 1.5% to 19,701.21.

united state Steel climbed 5.1% after Trump authorized an executive order on Friday paving the way for a financial investment in the business by Japan’s Nippon Steel. Trump would certainly have unique influence over the procedures of united state Steel under the regards to the bargain.

They assisted counter decreases for protection service providers, which returned several of their dives from Friday. Lockheed Martin dropped 4%, and Northrop Grumman sank 3.7%.

The rate of gold declined after getting on Friday, when financiers were trying to findsomeplace safe to park their cash An ounce of gold dropped $14.60 to $3,402.40 per ounce.

Capitalists have various other issues, trick amongst them Donald Trump’s tariffs, which still endanger to reduce the united state economic climate and elevate rising cost of living if Washington does not win profession take care of various other nations.

The specter of tolls was towering above the conference of the Group of Seven meeting of major economies in Canada.

Later on today, the Federal Get is readied to talk about whether to reduced or elevate rates of interest, with the choice due on Wednesday. The almost consentaneous assumption amongst investors and economic experts is that the Fed will certainly stand rub.

The Federal Get has actually waited to lower interest rates after one cut late in 2014. It is waiting to see just how much Trump’s tolls will certainly harm the economic climate and raising inflation, which has actually stayed tame just recently, and is near the Fed’s 2% target.

More vital for monetary markets on Wednesday will likely be projections for where Fed authorities they see the economic climate and rates of interest heading in upcoming years.

In various other ventures very early Tuesday, the united state buck was up to 144.59 Japanese yen from 144.75 yen. The euro climbed to $1.1564 from $1.1562.

___

AP Organization Author Stan Choe added.

.