Sales of formerly inhabited united state homes slowed down in March, a slow-moving begin to the springtime homebuying period as raised home mortgage prices and climbing costs inhibited possible home buyers.

Existing home sales dropped 5.9% last month from February to a seasonally changed yearly price of 4.02 million systems, the National Organization of Realtors claimed Thursday. The March sales decrease is the biggest regular monthly decline considering that November 2022, when sales dropped 6.7% from the previous month.

Sales dropped 2.4% compared to March in 2015. The current home sales disappointed the 4.12 million speed financial experts were anticipating, according to FactSet.

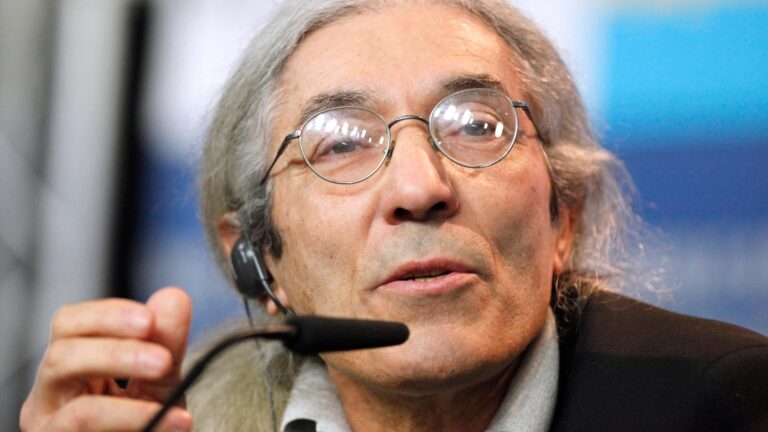

The typical price of a united state home mortgage, which reached its highest degree in 2 months recently, is a considerable obstacle for potential buyers, claimed Lawrence Yun, NAR’s primary financial expert.

” Residential real estate flexibility, presently at historic lows, indicates the problematic opportunity of much less financial flexibility for culture,” Yun claimed.

Home costs raised on a yearly basis for the 21st successive month, although at a slower price. The nationwide mean list prices climbed 2.7% in March from a year previously to $403,700, an all-time high for March, yet the tiniest yearly rise considering that August.

The united state real estate market has actually remained in a sales depression considering that 2022, when home mortgage prices started to climb up from pandemic-era lows. Sales of formerly inhabited united state homes dropped in 2015 to their cheapest degree in almost three decades.

Greater home mortgage prices additionally moistened the begin of the springtime homebuying period in 2024. This year, after reaching a simply over 7% in mid-January, the typical price on a 30-year home mortgage has actually stayed primarily raised, climbing up recently to 6.83%, its highest degree in 8 weeks, according to home mortgage customer Freddie Mac.

Sales dropped in March also as home buyers a lot more homes struck the marketplace for the springtime homebuying period.

There were 1.33 million unsold homes at the end of last month, an 8.1% rise from February, NAR claimed.

That converts to a 4-month supply at the existing sales speed, up from a 3.2-month speed at the end of March in 2015. Commonly, a 5- to 6-month supply is taken into consideration a well balanced market in between purchasers and vendors.

” I really felt that even more supply would certainly cause even more sales, yet that’s not the situation,” Yun claimed.