A little, expanding variety of companies are placing health insurance choices totally in the hands of their employees.

Rather than using typical insurance coverage, they’re offering employees cash to get their very own protection in what’s referred to as Private Insurance coverage Health And Wellness Repayment Plans, or ICHRAs.

Supporters state this method gives little business that could not pay for insurance coverage an opportunity to use something. It likewise caps an expanding expenditure for companies and fits conventional political objectives of offering individuals a lot more buying power over their protection.

However ICHRAs position the danger for discovering protection on the worker, and they require them to do something lots of disapproval: Purchase insurance coverage.

” It’s perhaps not ideal, yet it’s fixing a trouble for a great deal of individuals,” claimed Cynthia Cox, of the not-for-profit KFF, which examines healthcare problems.

Below’s a more detailed consider just how this method to medical insurance is advancing.

Usually, united state companies using health and wellness protection will certainly have 1 or 2 insurance coverage choices for employees with what’s referred to as a team strategy. The companies after that get a lot of the costs, or price of protection.

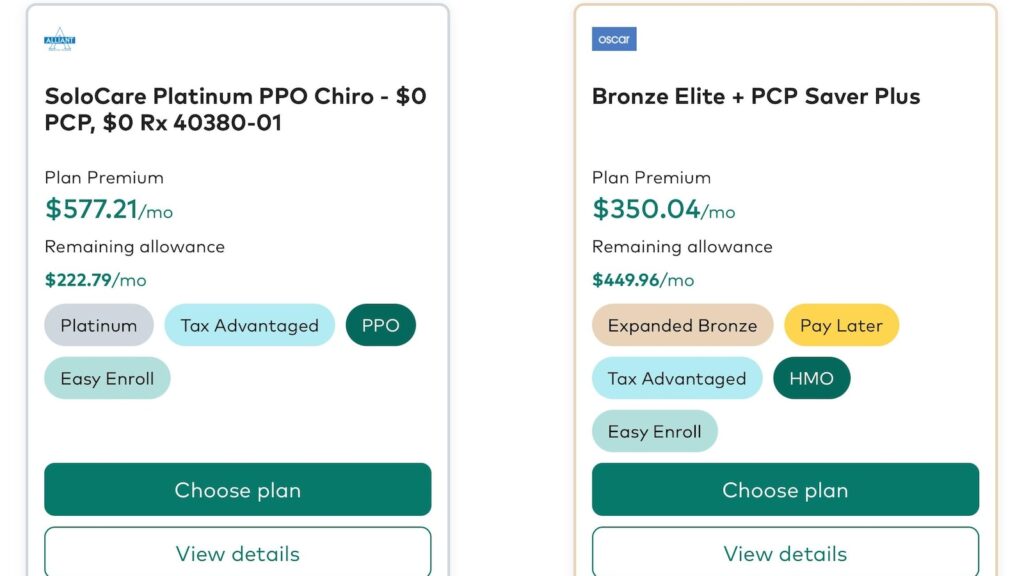

ICHRAs are various: Companies add to medical insurance protection, yet the employees after that choose their very own insurance coverage strategies. The companies that make use of ICHRAs employ outdoors companies to assist individuals make their protection choices.

ICHRAs were developed throughout Head of state Donald Trump’s very first management. Registration began gradually yet has actually swelled in the last few years.

They provide entrepreneur a foreseeable price, and they conserve business from needing to make protection choices for workers.

” You have a lot of points you require to concentrate on as a local business owner to simply really expand business,” claimed Jeff Yuan, founder of the New York-based insurance coverage start-up Taro Health and wellness.

Small companies, specifically, can be prone to yearly insurance coverage price spikes, particularly if some workers have costly clinical problems. However the ICHRA method maintains the company price even more foreseeable.

Yuan’s business bases its payments on the worker’s age and the number of individuals are covered under the strategy. That suggests it might add anywhere from $400 to greater than $2,000 regular monthly to a staff member’s protection.

ICHRAs allow individuals choose from amongst lots of choices in a private insurance coverage market rather than simply taking whatever their business supplies.

That might provide individuals an opportunity to locate protection a lot more customized to their demands. Some insurance providers, as an example, deal strategies created for individuals with diabetic issues.

And employees can maintain the protection if they leave– possibly for longer durations than they would certainly have the ability to with typical company medical insurance strategies. They likely will need to pay the complete costs, yet maintaining the protection likewise suggests they will not need to locate a brand-new strategy that covers their physicians.

Mark Bertolini, chief executive officer of the insurance company Oscar Health and wellness, kept in mind that many people transform tasks numerous times.

” Insurance policy functions finest when it relocates with the customer,” claimed the exec, whose business is expanding registration with ICHRAs in numerous states.

Medical insurance intends on the specific market often tend to have narrower protection networks than employer-sponsored protection.

It might be testing for people that see numerous physicians to locate one strategy that covers them all.

Individuals buying their very own insurance coverage can locate protection options and terms like deductibles or coinsurance frustrating. That makes it essential for companies to give aid with strategy option.

The broker or innovation system establishing a business’s ICHRA normally does this by inquiring about their clinical demands or if they have actually any type of surgical procedures intended in the coming year.

There are no great numbers country wide that demonstrate how many individuals have protection with an ICHRA or a different program for business with 50 employees or much less.

Nevertheless, the HRA Council, a profession organization that advertises the setups, sees large development. The council deals with business that assist companies use the ICHRAs. It examines development in an example of those companies.

It states regarding 450,000 individuals were supplied protection with these setups this year. That’s up 50% from 2024. Council Exec Supervisor Robin Paoli states the complete market might be two times as big.

Still, these setups compose a bit of employer-sponsored health and wellness protection in the USA. Regarding 154 million individuals were enlisted in protection with job in 2015, according to KFF.

Numerous points might create a lot more companies to use ICHRAs. As healthcare expenses remain to climb up, a lot more business might aim to restrict their direct exposure to the hit.

Some tax obligation breaks and motivations that urge the setups might end up in a last variation of the Republican tax bill presently present in the Us senate.

Even more individuals likewise will certainly be qualified for the setups if added federal government aids that assist get protection on the Affordable Treatment Act’s specific markets end this year.

You can not take part in an ICHRA if you are currently obtaining an aid from the federal government, kept in mind Brian Blase, a White Residence health and wellness plan advisor in the very first Trump management.

” The improved aids, they crowd out personal funding,” he claimed.

___

The Associated Press Health And Wellness and Scientific research Division gets assistance from the Howard Hughes Medical Institute’s Scientific research and Educational Media Team. The AP is exclusively in charge of all web content.