BANGKOK– Eastern shares were mainly greater Monday after the S&& P 500 and Nasdaq composite bordered back from their document degrees while the Dow inched to a brand-new document close.

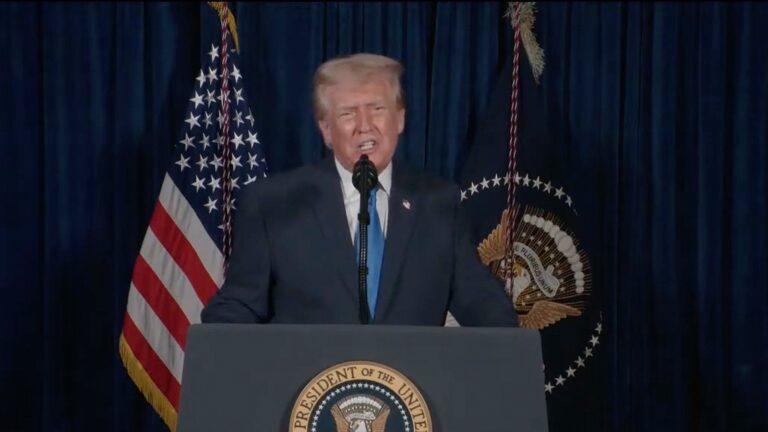

united state futures were little bit transformed as financiers looked for growths in the Ukraine dilemma adhering to a summit in between Head Of State Donald Trump and Russian Head Of State Vladimir Putin that brought no developments.

Japan’s Nikkei 225 obtained 0.8% to 43.714.31, while the Hang Seng in Hong Kong included 0.1% to 25,291.42.

The Shanghai Compound index leapt 1% to 3,732.44.

Australia’s S&& P/ASX 200 grabbed 0.2% to 8,959.30.

The Kospi in South Korea decreased 1.5% to 3,177.28 on hefty marketing of semiconductor manufacturers like Samsung Electronic devices, whose shares dropped 2.2%. SK Hynix shed 3.3% as financiers stressed over the opportunity of even more united state tolls on integrated circuit.

Trump was preparing to meet later on Monday with Ukrainian Head Of State Volodymyr Zelenskyy and various other European leaders in Washington.

The European lead were not consisted of in Trump’s summit with Russian Head of state Vladimir Putin last Friday. They are looking for to provide a joined front in securing Ukraine and the continent from any widening aggression from Moscow.

A yearly conference in Jackson Opening, Wyoming, of leading main lenders later on today will certainly be viewed very closely for tips regarding feasible rate of interest cuts from Federal Reserve chair Jerome Powell. He results from talk Friday at the financial plan meeting.

” While the main style is labor markets, financiers will certainly look at any kind of tip of September plan instructions, specifically after recently’s combined rising cost of living information,” Ipek Ozkardeskaya of Swissquote claimed in a discourse, including that “any kind of progression on Ukraine peace negotiation might press worldwide equities greater still.”

Assumptions have actually been developing that the Fed will certainly reduce rates of interest at its following conference in September, though combined records on the U.S. economy have actually damaged those wagers rather.

One record Friday claimed shoppers boosted their spending at united state merchants last month, while an additional claimed production in New york city state suddenly expanded. A 3rd claimed commercial manufacturing throughout the nation diminished last month, when financial experts were trying to find small development.

Yet an additional record recommended view amongst united state customers is intensifying due to fret about rising cost of living, when financial experts anticipated to see a small renovation.

On Wall Surface Road, UnitedHealth Team leapt 12% on Friday after well known capitalist Warren Buffett’s Berkshire Hathaway claimed it bought nearly 5 million shares of the insurer throughout the springtime, valued at $1.57 billion. Buffett is recognized for shopping great supplies at inexpensive costs, and UnitedHealth’s cut in half for the year by the end of July due toa run of struggles

Berkshire Hathaway’s very own supply slid 0.4%.

Applied Products assisted lead Wall surface Road reduced with a decrease of 14.1% although it reported much better outcomes for the most recent quarter than experts anticipated. The emphasis got on the business’s projection for a decrease in earnings throughout the present quarter.

Its items aid make semiconductors and progressed screens, and chief executive officer Gary Dickerson indicated a “vibrant macroeconomic and plan setting, which is developing boosted unpredictability and reduced exposure in the close to term, consisting of for our China organization.”

Sandisk dropped 4.6% regardless of reporting an earnings for the most recent quarter that blew previous experts’ assumptions. Financiers concentrated rather on the information storage space business’s projection commercial in the present quarter, which lost of Wall surface Road’s.

On Friday, the S&& P 500 dropped 0.3%. The Dow Jones Industrial Standard bordered 0.1% greater. The Nasdaq composite sank 0.4%.

In various other ventures early Monday, united state benchmark petroleum increased 24 cents to $63.04 per barrel, while Brent crude, the worldwide criterion, climbed up 16 cents to $66.01 per barrel.

The united state buck increased to 147.41 Japanese yen from 147.18 yen. The euro inched approximately $1.1705 from $1.1703.