BUKAVU, Congo– In the city of Bukavu in eastern Congo, Alain Mukumiro says in a little wood hut with a store owner that declines to take his cash.

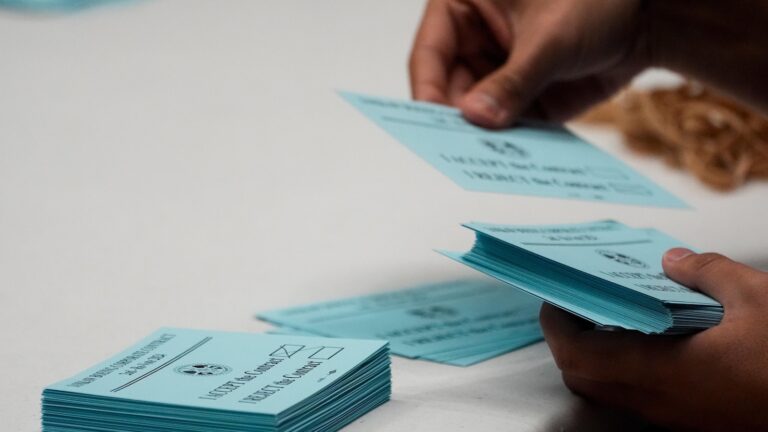

Like numerous in the rebel-controlled city, Mukumiro is utilizing older, hole-punched banknotes that have actually been repaired and return right into blood circulation due to a scarcity of brand-new and undamaged costs.

” All my cash has identification numbers, however they reject it,” Mukumiro stated, distressed concerning his challenge.

Mukumiro stated his family members encounters yet one more evening with vacant tummies, like numerous in Bukavu, the resources of South Kivu district.

The Rwanda-backed M23 rebel team recorded Bukavu in February adhering to an escalation of fighting in between the insurgents and Congolese pressures in the nation’s mineral-rich eastern. Congolese authorities shut the city’s financial institutions as the dispute increased, causing a scarcity of money in the area.

The perforated notes seem old costs that the financial institutions meant to ruin to take them out of blood circulation. It’s vague exactly how they returned onto the marketplace, however locals think they were taken from financial institution structures throughout the rebel requisition.

The older costs exchange for brand-new ones at a price of concerning 10-to-1, stated Ruboneka Mirindi Innocent, among a number of neighborhood citizens that currently service the underground market as money-changers.

” We maintain these banknotes since we do not understand what else to do, it’s simply to assist each various other out,” he stated.

The combating previously this year aggravated what was currently among the world’s largest humanitarian crises, with around 7 million individuals displaced and a lot more communities and cities dropping under the control of the rebels.

Financial institutions have actually stayed shut in Bukavu and and various other crucial cities in the area, such as Goma, protecting against the cities’ locals from accessing cash money. That has actually made life tough in Bukavu, which as soon as was expanding with financial task.

Having both undamaged and repaired notes in blood circulation at the very same time has actually caused complication and stress in between companies and clients.

” It’s a genuine frustration since some vendors approve them and others do not,” stated Mukumiro, 36.

A daddy of 3 functioning as a refrigerator service technician, Mukumiro and his family members are lacking concepts to deal as companies decrease the hole-punched banknotes– the only costs he has actually left.

Zihalirwa Rutchababisha, that possesses a repair work tools service, stated he does decline the broken banknotes to stay clear of any kind of loss.

” We are likewise encountering the very same scenario as them,” Rutchababisha stated concerning his clients captured up in the scenario. “If I take them, I will not have the ability to utilize them to acquire products which would certainly place me muddle-headed.”

Rutchababisha’s $120 once a week earnings in 2014 has actually currently plunged to $20 a week under the M23, mostly as an outcome of diminishing sales.

In the rebel-held regions consisting of Bukavu, a number of state staff members as soon as paid in cash money state they currently make money by means of on the internet transfers.

However this fixes the issue for a pick couple of. The state staff members just make up around 2% of Bukavu’s populace of over 1.3 million. The majority of the city’s locals operate in the casual field and are paid in cash money.

David Kyanga, a teacher of business economics at Bukavu’s Greater Institute of Business, stated the only service is for the M23-controlled cities to take on the faulty banknotes as legitimate methods of settlement in the lack of cash money products from Congolese financial authorities.

The M23 might relax stress by notifying individuals that the hole-punched banknotes stand, he stated.

Recently, Patrick Busu Bwasingwi Nshombo, the M23-appointed guv of South Kivu district, asked locals to trade their perforated notes in among the financial institutions the rebels opened up.

However Nshombo promptly put on hold the procedure days later on, stating the financial institution representatives were bewildered by the lots of banknotes advanced to be altered.

Congo’s federal government agent in Kinshasa Patrick Muyaya stated Thursday that the authorities will certainly not send out banknotes or resume financial institutions in rebel-held regions like Bukavu.

” No financial institution can open its doors in a circumstance of instability like what is taking place in locations inhabited by the M23,” Muyaya stated at an interview.

He examined exactly how financial institutions might deal with M23 when it encounters united state Treasury assents.

” We do not understand that will certainly conserve us,” Mukumiro, the service technician, stated. “The federal government in Kinshasa disregards, and the liberators likewise see the scenario without doing something about it,” he included, describing M23.

___

Banchereau reported from Dakar, Senegal. Jean-Yves Kamale in Kinshasa, Congo added to this record.

___

For a lot more on Africa and advancement: https://apnews.com/hub/africa-pulse

The Associated Press obtains financial backing for international wellness and advancement protection in Africa from the Gates Structure. The AP is entirely in charge of all web content. Discover AP’s standards for collaborating with philanthropies, a listing of fans and moneyed protection locations at AP.org.