STAVANGER, Norway– Flourishing Norway is holding a political election on Monday with inequality high up on the listing of problems and the future of a wide range tax obligation that has actually withstood for over a century doubtful.

There is anticipated to be a close result in between the center-left bloc led by the Labor Celebration of Prime Minister Jonas Gahr Støre, Norway’s leader for the previous 4 years, and a conservative bloc.

Labor wishes to maintain the wide range tax obligation that has actually been an essential of Norwegian plan given that 1892. Of its opponents on the right, the Conservatives desire it lowered and the Development Celebration, which requires reduced tax obligations and even more migration controls, desires it junked. Formerly an edge concern, it has actually gone to the heart of this project.

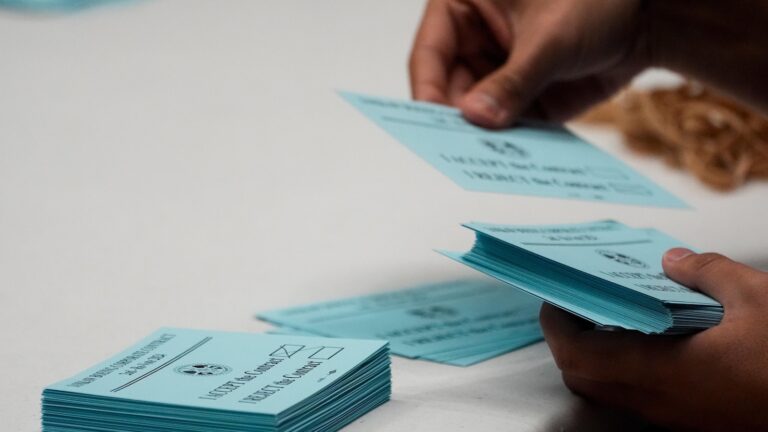

Around 4.3 million individuals in the country of some 5.6 million are qualified to choose the brand-new 169-member parliament, or Storting. Main outcomes are anticipated on Tuesday. They are typically complied with by weeks of horse-trading to create a union and settle on cupboard placements.

The outcome isn’t most likely to have significant effects for Norway’s diplomacy. The nation is a solid participant of NATO and a solid fan of Ukraine’s protection versus Russia.

The wide range tax obligation is a levy of as much as 1.1% on possessions and shares worth greater than 1.76 million kroner (around $176,000), though there are numerous decreases and price cuts, as an example gauging financial obligation and residential or commercial property. Labor claims that junking it would certainly set you back 34 billion kroner ($ 3.3 billion) each year.

The Development Celebration, which leads the conservative union, is asking for the wide range tax obligation to be eliminated, suggesting that it is harmful to the economic situation. Celebration leader Sylvie Listhaug suggests that it punishes business owners that may have taxed risks in important business, however little genuine earnings.

” The cash paid in wide range tax obligation can have been invested producing services, brand-new work and even more technology,” Listhaug composed in an e-mail to The Associated Press.

Surveys reveal Listhaug’s event in advance of the Conservatives, led by previous Head of state Erna Solberg, that were the elderly companion in the last center-right federal government from 2013 to 2021. It has actually been reinforced by an energised social networks project, driven by vibrant influencers that have actually motivated more youthful citizens versus the tax obligation.

” I believe that youngsters are actually dissatisfied regarding the instructions that Norway is taking,” claimed Listhaug, mentioning problems regarding migration, criminal activity, abroad help and environment-friendly aids as crisis problems for young citizens. “The future appears much less intense so they desire a modification.”

Norway is just one of the wealthiest nations worldwide. It has a charitable well-being state, remains on billions of barrels of oil and gas, and has among the globe’s biggest sovereign wide range funds, worth around 20 trillion kroner ($ 2 trillion). Gdp each is the sixth-highest worldwide, one area over the united state, according to the International Monetary Fund.

It is likewise among the globe’s most egalitarian nations, sharing its wide range far more uniformly than lots of others– and the means Norway’s treasures have actually been utilized for worldwide help and financial investment has actually likewise become a project concern.

Several, consisting of the Labor Celebration, claim the wide range tax obligation is just one of one of the most reliable bars for getting rid of inequality. Norway is just one of just 3 nations in the 38-member Organization for Economic Co-operation and Development, a club of abundant nations, which imposes a tax obligation on web wide range.

Among its champs is the nation’s most prominent political leader, Jens Stoltenberg, a previous secretary-general of NATO. Gahr Støre encouraged Stoltenberg, that is likewise a previous head of state, to go back to federal government as money priest in February. That was complied with by a 10-point bump in surveys for Labor.

Stoltenberg said in a preelection dispute on public broadcaster NRK that a lot of the wealthiest Norwegians would certainly wind up paying “practically absolutely nothing” if the wide range tax obligation was junked.

Also in the abundant nation, rising cost of living gets on lots of minds: The Norwegian reserve bank claims the Customer Cost Index increased 3.3% over the last one year– well over the financial institution’s target price of 2%.

A few of the wealthiest have actually currently elected with their feet.

When the Labor federal government played with the tax obligation in 2022, getting rid of several of its exceptions, it sped up an exodus of ultra-wealthy Norwegians to Switzerland, consisting of the wealthiest, Kjell Inge Røkke.

Great riddance, claim some Norwegians that whine regarding their compatriots taking advantage of a steady economic situation and tax obligation financed education and learning, after that decamping as opposed to paying their means.

” There was an expanding bitterness that some abundant individuals did not pay or participate in the financing of the well-being state as they should,” claimed Bernt Aardal, a political election scientist and teacher at the College of Oslo.

Among the reasons that the wide range tax obligation has actually played such a function in this political election is due to the fact that social networks influencers have actually concentrated on the concern.

The primary event leaders have all showed up on Gutta (The Individuals), a prominent YouTube network, which allures particularly to boys and raids the tax obligation.

” The amusing point is that numerous more youthful citizens, that are not impacted by the tax obligation, are mentioning it as the primary concern in this project,” Aardal claimed. “So it will certainly interest see if it not just galvanizes point of view however encourages them to elect.”