WASHINGTON– The united state Treasury Division stated Thursday it prepares to reclassify particular refundable tax obligation credit histories as “government public advantages,” which will certainly disallow some immigrant taxpayers from getting them, also if they submit and pay tax obligations and would certainly or else certify.

Tax obligation professionals state immigrants gave the united state unlawfully by their moms and dads as kids, referred to as DACA (Deferred Activity for Youth Arrivals) receivers, and immigrants with Temporary Protected Condition are probably to be impacted by the organized adjustment. International employees and trainee visa owners along with some households with kids that are united state residents might likewise be impacted, relying on just how the guideline is created, they state.

The Treasury Division’s statement was the current indication of just how the Trump management has actually been taking a” whole of government” method when it involves migration enforcement and aiming to divisions throughout the federal government– not simply Homeland Safety and security– to find up with means to assist perform the head of state’s hardline migration program.

The Treasury stated in its statement that it prepares to craft brand-new regulations influencing the reimbursed parts of particular private earnings tax obligation credit histories, consisting of the Earned Revenue Tax Obligation Credit Scores, the Added Kid Tax Obligation Credit Scores, the American Possibility Tax Obligation Credit Scores and the Saver’s Suit Credit rating.

The rule-making would certainly redefine the tax obligation credit histories as “government public advantages” within the significance of Individual Duty and Job Possibility Settlement Act of 1996. Because of this, numerous immigrants with united state job permission would certainly no more have the ability to get these advantages.

According to the Institute on Taxes and Economic Plan, undocumented immigrants that pay tax obligations are commonly not qualified for the exact same tax obligation advantages as united state residents, although this team of individuals paid almost $100 billion in federal, state, and local taxes in 2022.

As an example, undocumented immigrants are not eligible for Social Security retirement benefits or Medicare health insurance, although they add billions of bucks to the government pay-roll tax obligations that money these advantages.

Movie critics pounded the adjustment as a method to target immigrants as component of Trump’s more comprehensive plans.

” It’s an awful and unjust concept to reject tax obligation credit histories to individuals that have actually paid tax obligations and are qualified for them as a result of their migration standing,” stated Daniel Costa, supervisor of Migration Legislation and Plan Research Study at the Economic Plan Institute.

” Applying this will certainly call for identifying that has standing and that does not, which is an additional manner in which the Trump management will certainly broaden its expulsion dragnet.”

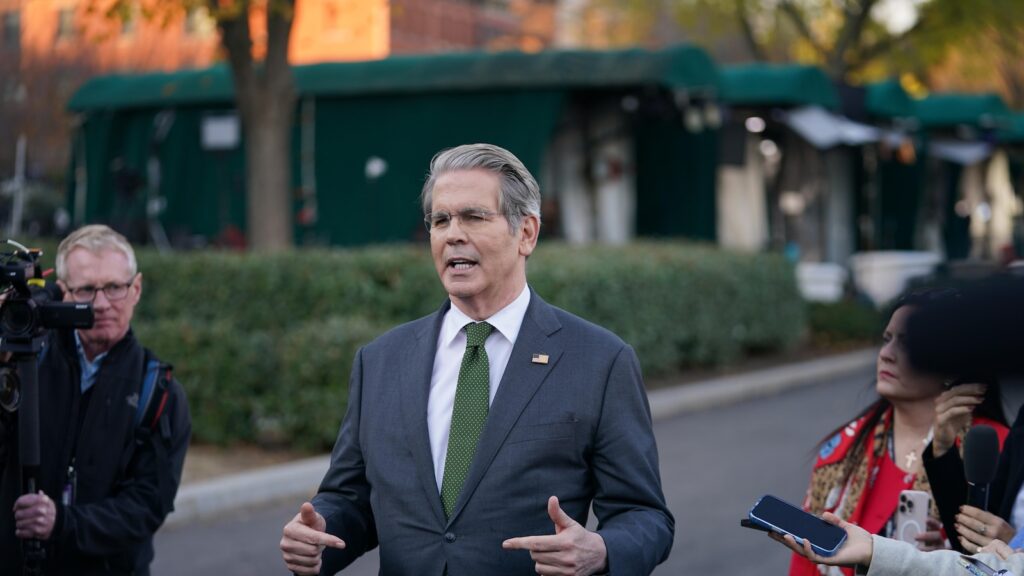

The last guideline is anticipated to use start in tax obligation year 2026. Treasury Assistant Scott Bessent stated in a press release that “we are applying the legislation and stopping unlawful aliens from declaring tax obligation advantages meant for American residents.” Treasury looked for a Justice Division reinterpretation of the legislation in order to craft the brand-new guideline, the firm stated.

Carl Davis, research study supervisor of the Institute on Taxes and Economic Plan, stated because individuals without job permission currently do not receive these refundable tax obligation credit histories, “the individuals that are actually mosting likely to be affected are individuals that are actually attempting to do the appropriate point, individuals licensed to function and paying their tax obligations.”

He stated he thought the management was attempting to make the lives of taxpaying immigrants harder.

NYU Tax Obligation Legislation Facility Plan Supervisor Brandon DeBot stated in a declaration that the Treasury’s reinterpretation of the legislation in order to craft a brand-new guideline for the tax obligation credit histories “bypasses such clear stipulations of the tax obligation code.”

” Refuting tax obligation credit histories to immigrant households needs Congress to act clearly,” DeBot stated.

Davis stated there most likely would not be bulk assistance for the relocate Congress, which he stated most likely motivated the management to act unilaterally on the problem rather.

” The American individuals are extensively understanding to the Dreamers and DACA receivers. Targeting them in this ambiguous method, that’s not a plan adjustment that would certainly’ve had bulk assistance in Congress,” he stated.

___

Salomon added from Miami.

.