WASHINGTON– 2 Federal Get authorities revealed resistance Wednesday to one more rate of interest reduced at the reserve bank’s following conference in December, further muddying the expectation for the Fed’s following actions.

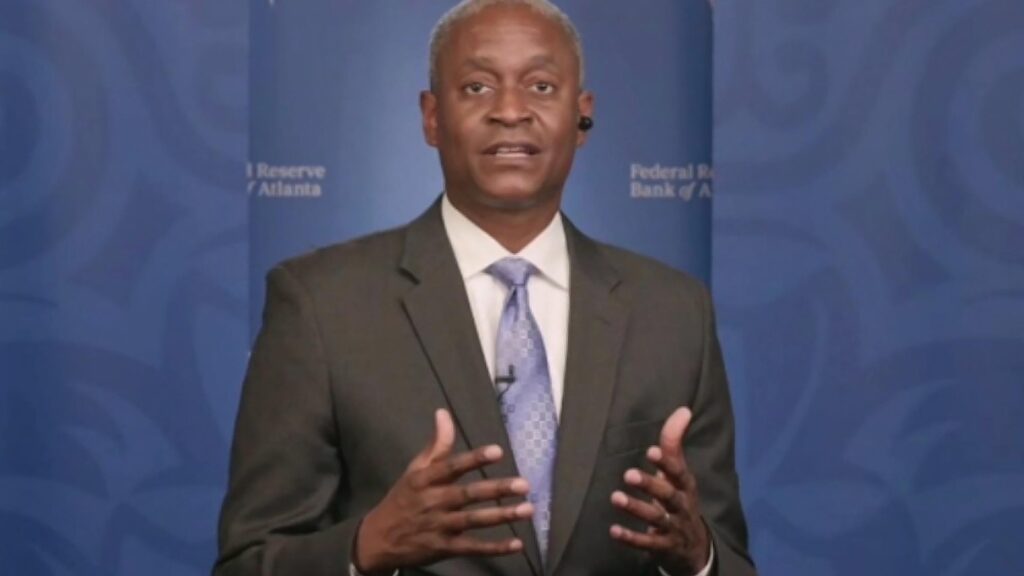

The comments by Susan Collins, head of state of the Reserve bank of Boston, and Raphael Bostic, head of state of the Atlanta Fed, recommend that the reserve bank’s rate-setting board can be turning versus what had actually been an anticipated 3rd straight cut following month.

The authorities mentioned numerous factors for maintaining prices unmodified, after a decrease in September and inOctober They suggested that rising cost of living is stubbornly raised and has actually been over the Fed’s 2% target for virtually 5 years, while the economic situation is durable and does not show up to require even more price cuts. The task market is stumbling, with employing virtually stationary, however discharges still appear soft, they stated.

An additional variable has actually been the federal government closure, which has cut off the economic data the Fed relies upon to recognize the economic situation’s course. On Wednesday White Home spokesperson Karoline Leavitt stated that the tasks and rising cost of living records for October would likely never ever be launched.

” Creating a financial expectation is testing– and the restricted information substances the problem,” Collins stated in a speech in Boston.

” It will likely be ideal to maintain plan prices at the existing degree for a long time … in this extremely unclear setting,” she included.

That is a change from her previous speech in October, when she revealed assistance for at the very least another price cut.

Previously Wednesday, Bostic stated he stays worried rising cost of living is too expensive, and included that, “I … support maintaining the funds price consistent up until we see clear proof that rising cost of living is once again relocating meaningfully towards its 2% target.” Bostic stated previously Wednesday that he will retire when his existing term upright Feb. 28, 2026.

Their comments come with an abnormally difficult time for the Fed, with the economic situation dealing with both weak hiring and raised rising cost of living. Generally, the Fed would certainly decrease its price to urge loaning, investing and task gains, while it would certainly maintain it unmodified– and even increase it– to deal with rising cost of living.

The 19 authorities on the Fed’s rate-setting board directly sustained 3 price cuts this year at their September conference, however Chair Jerome Powell stated at a press conference late last month that the board stays divided and one more cut in December was not a “inevitable verdict.”

David Seif, primary economic expert for established markets at Nomura Stocks, anticipates the Fed will certainly avoid a price reduced in December and will not decrease loaning prices once again up until March.

” There is a huge sector of the Fed that is awkward with a December cut,” Seif stated.

Collins additionally stated that extra decreases to the Fed’s price could, by increasing the economic situation, speed up rising cost of living.

” Lacking proof of a remarkable labor market degeneration, I would certainly be reluctant to relieve plan even more, particularly offered the restricted info on rising cost of living as a result of the federal government closure,” she stated.

Bostic, on the other hand, stated the Atlanta Fed’s studies of companies reveal that lots of firms mean to increase rates following year, an indication that rising cost of living might not cool down anytime quickly.

” We can not breezily think inflationary stress will promptly dissipate after a single bump in rates from brand-new import obligations,” Bostic stated, describing Head of state Donald Trump’s tolls. “Throughout all our info resources, I see little to no proof that we need to be positive concerning the forward trajectory of rising cost of living.”

Some Fed authorities, such as Fed guv Stephen Miran, have actually suggested that the tolls will just momentarily raise rates and outside those single boosts, rising cost of living is cooling down.

.