This tale was originally published by KABC, an ABC had and ran tv terminal.

The Golden State Insurance Policy Commissioner Ricardo Lara is informing homeowners whose homes or services were harmed or damaged by wildfires today to not authorize anything today– to be a little individual.

An effective hurricane that banged Southern The golden state on Tuesday promptly drove wildfires throughout the area, requiring thousands to leave and melting regarding 23,000 acres.

Authorities stated at the very least 1,100 frameworks have actually been damaged by the fires.

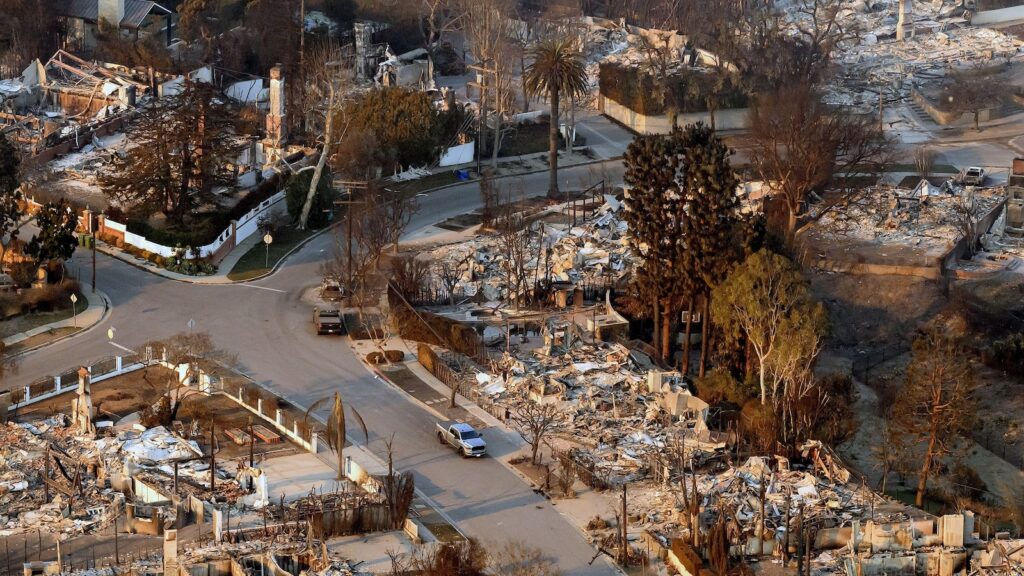

In this bird’s-eye view extracted from a helicopter, melted homes are seen from over throughout the Palisades fire in the Pacific Palisades community of Los Angeles, Jan. 9, 2025.

Josh Edelson/AFP by means of Getty Photos

Lara highlighted throughout an ABC7 online meeting that firstly you need to access safety and security, steer clear of from the hot spot and do not hurry right into any kind of choices. There is a three-day ceasefire agreement that homeowners are permitted prior to they require to make any kind of choice with a public insurance adjuster.

” Frequently what we have actually seen, however, throughout several fires in various years throughout the state, is you begin seeing out-of-state insurance adjusters been available in, attempting to, you recognize, reduce a bargain with house owners, claiming you recognize, ‘We can offer you 70% of what you are qualified to when you are truly qualified to 100%– or relying on what your plan claims,” Lara clarified regarding individuals being at risk to scams throughout theses demanding and stressful times.

By stopping briefly and waiting to authorize, individuals can capture a prospective scams prior to it’s far too late. Lara stated individuals can call the insurance policy division to examine the insurance policy insurer’s permit. He additionally suggested individuals to call their insurer prior to authorizing anything with an insurance adjuster.

” We’re simply asking individuals to call our division, do not authorize anything under discomfort,” Lara stated. “This is a really stressful minute … and we intend to allow them recognize that please keep an eye out for scams, do not authorize anything, and we’re right here to be able to aid them via the whole procedure.”

In this bird’s-eye view extracted from a helicopter, melted homes are seen from over throughout the Palisades fire in Malibu, Los Angeles Region, Calif., Jan. 9, 2025.

Josh Edelson/AFP by means of Getty Photos

Lara highlighted individuals need to call the California Division of Insurance Policy. They have online drivers on the phone that can aid resolve your problems. You can call them at 1-800-927-4357 or see insurance.ca.gov.

” It’s extremely vital that you recognize you have someone in your corner,” Lara stated. “The division is right here to be your supporter throughout this extremely demanding and truly traumatizing time for our area.”

When attempting to find out your insurance policy protection, Lara stated one of the most vital point you require is a duplicate of your home insurance coverage.

” You additionally need to bear in mind of your added living costs, limitations in your plan and additionally track every one of your added costs,” he included. “And you need to see to it you record all discussions with your insurance firm or an insurance adjuster.”

As wildfires throughout the state ended up being a lot more common and damaging, insurer have actually begun going down protection for house owners in fire-prone locations or considerably elevating plan prices. Lara informed ABC7 there is a legislation in position that doesn’t allow insurance companies to drop coverage to locations within a year of a wildfire, providing service and households time to choose regarding their futures.

See if you’re safeguarded or if your postal code is consisted of in the moratorium on nonrenewals here.

An additional method to maintain insurer in neighborhoods is to lower the danger of fire damages to your home, Lara stated. Home owners can do that by making the home depends on code, the roofing is upgraded and solidify your home versus fires.

Obtain even more details on fortifying your home from wildfires here.