NEW YORK CITY– The USA is lacking cents.

Head of state Donald Trump’s decision to stop producing the penny previously this year is beginning to have genuine effects for the country’s business. Sellers in numerous areas of the nation have actually lacked cents and are incapable to generate precise adjustment. At the same time, financial institutions are incapable to get fresh cents and are allocating cents for their consumers.

One corner store chain, Sheetz, obtained so determined for cents that it quickly ran a promo supplying a totally free soft drink to consumers that generate 100 cents. An additional store states the absence of cents will certainly wind up costing it millions this year, due to the requirement to round to stay clear of suits.

” It’s a piece of adjustment,” stated Dylan Jeon, elderly supervisor of federal government relationships with the National Retail Federation.

The cent trouble began in late summertime and is just becoming worse as the nation heads right into the vacation purchasing period.

To ensure, not one store or financial institution has actually required the cent to stay. Dimes, specifically wholesale, are hefty and are typically utilized specifically to provide consumers alter. Yet the sudden choice to remove the cent has actually featured no advice from the federal government. Several shops have actually been left advocating Americans to pay in precise adjustment.

” We have actually been promoting abolition of the cent for thirty years. Yet this is not the method we desired it to go,” stated Jeff Lenard with the National Organization of Ease Shops.

Trump revealed on Feb. 9 that the united state would certainly no more mint cents, pointing out the high prices. Both the cent and the nickel have actually been a lot more costly to generate than they deserve for numerous years, in spite of initiatives by the united state Mint to lower prices. The Mint invested 3.7 cents to make a dime in 2024, according to its newest yearly record, and it invests 13.8 cents to make a nickel.

” Allow’s tear the waste out of our excellent country’s budget plan, also if it’s a dime at once,” Trump created on Fact Social.

The Treasury Division stated in Might that it was positioning its last order of copper-zinc planchets– the empty steel disks that are produced right into coins. In June, the last cents were produced and by August, those cents were dispersed to financial institutions and armored lorry solution business.

Troy Richards, head of state and principal procedures police officer at Louisiana-based Warranty Financial Institution && Trust fund Co., stated he’s needed to clamber to have adequate cents handy for his consumers given that August.

” We obtained an e-mail statement from the Federal Get that cent deliveries would certainly be reduced. Little did we understand that those deliveries were currently over for us,” Richards stated.

Richards stated the $1,800 in cents the financial institution had actually were entered 2 weeks. His branches are maintaining percentages of cents for consumers that require to pay checks, however that’s it.

The united state Mint released 3.23 billion cents in 2024, the last complete year of manufacturing, greater than dual that of the second-most produced coin in the nation: the quarter. Yet the trouble with cents is they are released, offered as adjustment, and hardly ever recirculated back right into the economic climate. Americans keep their cents in containers or utilize them for design. This needs the Mint to generate substantial amounts of cents yearly.

The federal government is anticipated to conserve $56 million by not producing cents, according to the Treasury Division. In spite of shedding cash on the cent, the Mint pays for the united state federal government with its manufacturing of various other distributing coins along with coin evidence and celebratory collections that interest numismatic collection agencies.

In 2024, the Mint made $182 million in seigniorage, which is its matching of earnings.

Besides American’s cent hoarding routine, a logistical concern is additionally avoiding cents from distributing.

The circulation of coins is taken care of by the Federal Get system. Numerous business, primarily armored provider business, run coin terminals where financial institutions can take out and transfer coins. Approximately a 3rd of these 170 coin terminals are currently near to both cent down payments along with cent withdrawals.

Financial institution powerbrokers claim these terminals being shut to cent down payments is worsening the cent lack, since components of the nation that might have some excess cents are incapable to obtain those cents to components of nation with lacks.

” As an outcome of the united state Division of the Treasury’s choice to finish manufacturing of the cent, coin circulation areas approving cent down payments and satisfying orders will certainly differ with time as (cent) supply is diminished” a Federal Get spokesperson stated.

The absence of cents has additionally come to be a lawful minefield for shops and merchants. In some states and cities, it is unlawful to assemble a purchase to the nearby nickel or penny since doing so would certainly contravene of regulations that are intended to position cash money consumers and debit and bank card consumers on an equivalent having fun area when it concerns product prices.

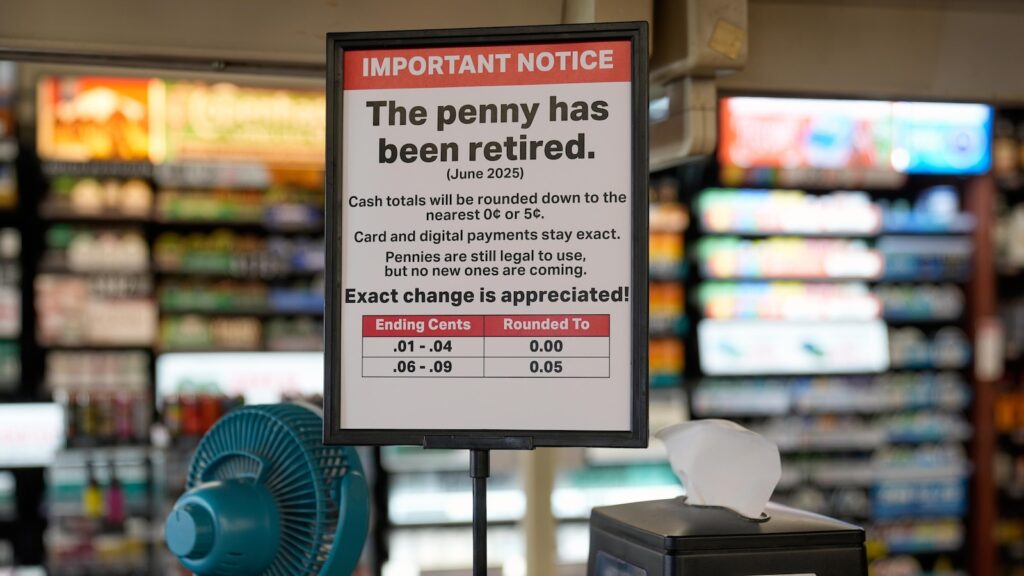

So, to stay clear of suits, merchants are rounding down. While 2 or 3 cents might not feel like a lot, that added adjustment can build up over 10s of hundreds of deals. A spokesperson for Kwik Journey, the Midwest corner store chain, states it has actually been rounding down every cash money purchase to the nearby nickel. That’s anticipated to set you back the firm about $3 million this year. Some merchants are asking consumers to provide their adjustment to neighborhood or associated charities at the sales register, in an initiative to stay clear of cents too.

A costs presently pending in Congress, called the Typical Cents Act, asks for cash money deals to be rounded to the nearby nickel, up or down. While the proposition is tasty to organizations, assembling might be expensive for customers.

The Treasury Division did not reply to an ask for talk about whether they had any type of advice for merchants or financial institutions pertaining to the cent lack, or the concerns pertaining to cent flow.

The USA is not the very first nation to shift far from tiny religion coins or cease obsolete coins. Yet in all of these instances, federal governments relax using their obsolete coins over a duration of, typically, years.

As an example, Canada revealed it would certainly remove its one-cent coin in 2012, transitioning far from one-cent cash money deals beginning in 2013 and is still compensatory and reusing one-cent coins a years later on. The “decimalization” procedure of transforming British coins from quarters and shillings to a 100-pence-to-a-pound system took a lot of the 1960s and very early 1970s.

The united state eliminated the cent from business suddenly, with no activity by Congress or any type of regulative advice for financial institutions, merchants or states. The retail and financial sectors, hardly ever allies in Washington on plan issues associated with point-of-sale, are requiring that Washington concern advice or pass a regulation repairing the concerns that are occurring because of the lack.

” We do not desire the cent back. We simply desire some kind of quality from the federal government on what to do, as this concern is just going to obtain even worse,” the NACS’ Lenard stated.