SACRAMENTO, Calif.– SACRAMENTO, Calif. (AP)– The Golden State Gov. Gavin Newsom authorized a bipartisan expense Thursday that intends to avoid the state’s home insurance company of last resource from lacking cash adhering to an all-natural catastrophe.

The FAIR Plan is an insurance policy swimming pool that gives plans to individuals that can not obtain exclusive insurance policy due to the fact that their residential properties are considered as well high-risk to guarantee. The variety of home owners compelled onto the FAIR Strategy has actually increased. With high costs and standard insurance coverage, the strategy is developed as a momentary alternative till home owners can locate long-term insurance coverage.

Yet extra Californians are relying upon it than ever before as significantly damaging and devastating fires trigger throughout the state, consisting of in largely booming locations. There were virtually 600,000 home plans on the FAIR Strategy since June. Leaders of the strategy in 2014 alerted state legislators that it can go financially troubled after a significant wildfire or catastrophe.

That truth happened previously this year after wildfires swept through Los Angeles and damaged greater than 17,000 frameworks. The strategy encountered a loss of about $4 billion and required a $1 billion bailout from exclusive insurance providers to pay cases. Fifty percent of that price is anticipated to be passed onto all insurance holders.

The legislation Newsom authorized enables the FAIR Strategy to demand state-backed financings and bonds and expanded cases repayments over several years after a catastrophe. Insurance provider were formerly called for to pay the complete bailout within thirty day. Advocates of the brand-new legislation claimed it will certainly protect against the requirement for future bailouts that elevate prices for every person.

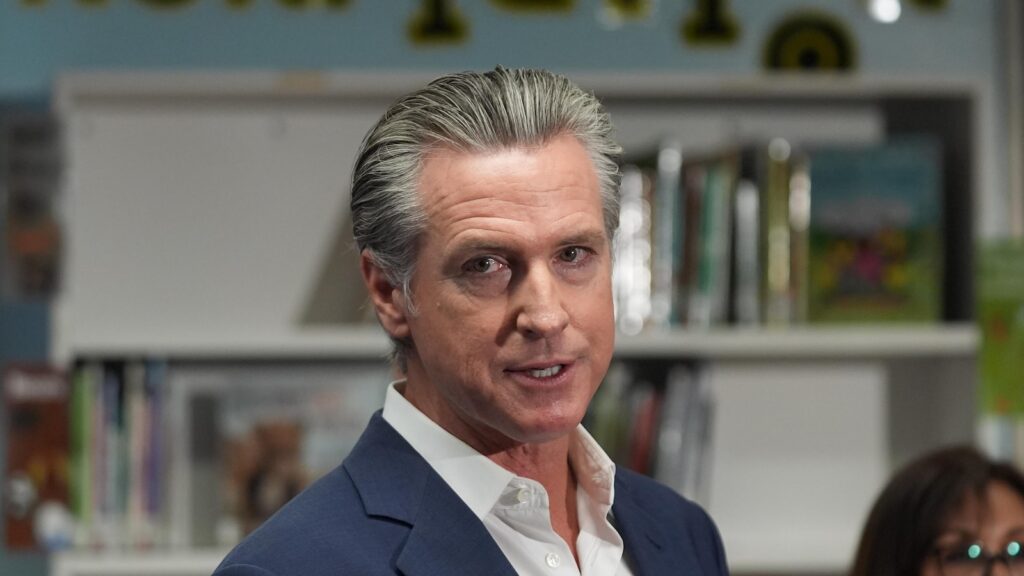

” The sort of climate-fueled firestorms like we saw in January will just remain to aggravate in time. That’s why we’re doing something about it currently to proceed reinforcing The golden state’s insurance policy market to be extra durable despite the environment situation,” Newsom claimed in a declaration.

Republican state Sen. Marie Alvarado-Gil claimed the step was a great action to assist support the FAIR Strategy.

” This expense does not address whatever. Yet it does assist to make sure that the FAIR Strategy clients can rely upon insurance coverage in their time of best requirement,” she claimed in September throughout a flooring argument.

Newsom additionally authorized an additional expense to broaden the FAIR Strategy board, which presently includes 9 ballot insurance providers and 4 nonvoting participants assigned by the guv. The brand-new legislation includes 2 reps from the Legislature to work as non-voting participants on the board.

Advocates, consisting of the state’s leading insurance policy regulatory authority, claimed the legislation includes a brand-new layer of oversight and openness. Challengers claimed it would not make a distinction due to the fact that the brand-new participants do not have any type of ballot power.

The golden state is undertaking a yearslong initiative to support its insurance policy market after a number of significant insurer either paused or restricted brand-new organization in the state in 2023, which pressed numerous countless home owners onto the FAIR Strategy. Wildfires are coming to be extra usual and devastating in The golden state due to climate change, and insurance providers state that is making it hard to absolutely value the danger on residential properties.

Of the leading 20 most devastating wildfires in state background, 15 have actually taken place because 2015, according to the California Division of Forestry and Fire Security.

The state currently offers insurance providers extra latitude to elevate costs for providing extra plans in risky locations. That consists of policies enabling insurance providers to consider climate change when establishing their rates and enabling them hand down the prices of reinsurance to The golden state customers.