A business that possesses strip clubs around the nation and numerous of its execs have actually been billed with paying off a federal government authorities with totally free journeys to a few of the clubs and hundreds of bucks in investing cash to prevent paying greater than $8 million in sales tax obligations to New york city City and the state of New york city, district attorneys claimed Tuesday.

New York City Chief Law Officer Letitia James claimed the claimed system by Houston-based RCI Friendliness Holdings and its business leaders ranged from 2010 to 2024 and entailed paying off a New york city state tax obligation auditor, for getting positive therapy throughout a minimum of 6 tax obligation audits that were executed over a years.

RCI Friendliness, openly traded on the Nasdaq compound, possesses and runs greater than 60 clubs and sporting activities bars and dining establishments throughout the region, consisting of Rick’s Cabaret facilities situated in greater than a loads cities consisting of New york city City, according to the firm’s site. It additionally possesses 2 various other services in Manhattan.

A 79-count grand court charge that was unsealed Tuesday costs RCI, 5 of its execs and the 3 clubs in Manhattan with conspiracy theory, bribery, tax obligation scams and various other criminal offenses.

” RCI’s execs shamelessly utilized their strip clubs to reward their escape of paying numerous bucks in tax obligations,” James claimed in a declaration. “I will certainly constantly act to eliminate corruption and make sure everybody pays their reasonable share.”

Daniel Horwitz, a New york city legal representative for RCI, contested the claims and claimed the accuseds will certainly combat the costs in court.

” We are plainly dissatisfied with the New york city Chief law officer’s choice to progress with a charge and expect dealing with the claims,” Horwitz claimed in a declaration. “We advise everyone that these charges include just claims, which our company believe are ungrounded. RCI and the people entailed are assumed innocent and must be enabled to have their day in court.”

He included that RCI’s plan is to pay “all genuine and non-contested tax obligations” and all 3 Manhattan clubs stay open.

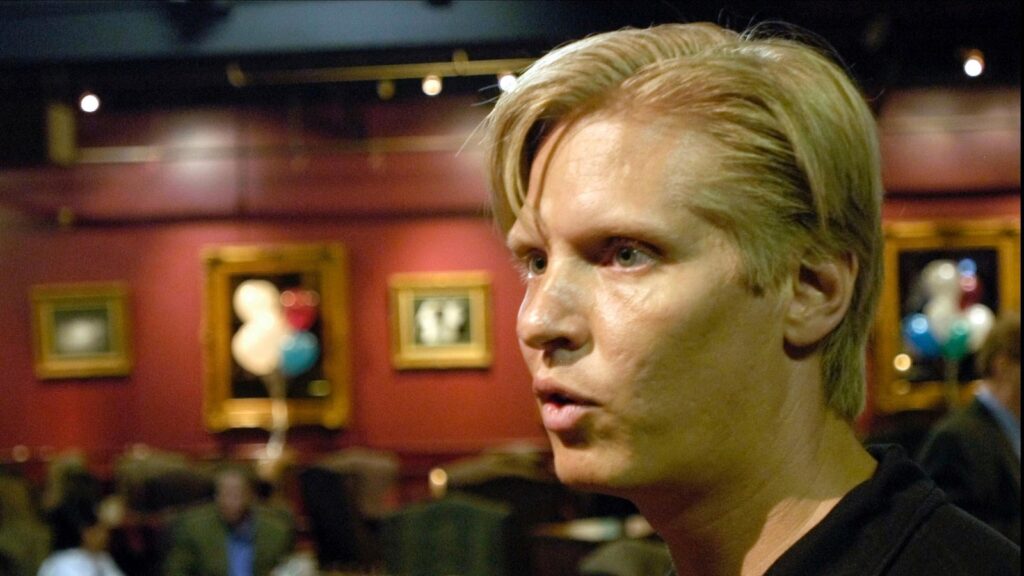

Amongst the RCI execs that were prosecuted are Eric Langan of Bellaire, Texas, president, head of state and board chairman; and Timothy Winata of Houston, a controller and accounting professional. District attorneys declare Langan and various other execs licensed and look after the kickbacks, and Winata straight gave the kickbacks and gone along with the auditor on journeys to the clubs.

James’ workplace did not call the New york city state auditor. It claimed that a 6th individual that was not openly called was prosecuted however not yet apprehended. James’ workplace decreased to state whether that individual was the auditor. The name of the auditor, that benefited the New york city State Division of Tax and Financing, is redacted in the charge.

District attorneys claimed RCI offered the auditor a minimum of 13 free, multiday journeys to Florida and as much as $5,000 each day to invest in exclusive dancings at RCI strip clubs, consisting of Tootsie’s Cabaret in Miami. The auditor’s resort and dining establishment costs were additionally spent for by RCI, authorities claimed.

Winata additionally took a trip from Texas to Manhattan to offer the auditor kickbacks at the 3 Manhattan clubs– Rick’s Cabaret, Brilliant Cabaret and Hoops Cabaret and Sports Bar, district attorneys claimed.

The charge declares RCI fell short to pay over $8 million in sales tax obligations on the sale of “dancing bucks,” which are bought by consumers and retrieved for exclusive dancings. The auditor, district attorneys affirmed, resolved tax obligation audits of RCI’s Manhattan clubs for significantly much less in back tax obligations, charges and rate of interest than were owed, conserving the firm numerous bucks.