WASHINGTON– Golf caddies, blackjack suppliers and residence painters are amongst the tasks covered under the Trump administration’s initial listing of professions no needed to pay revenue tax obligation on their pointers under Republican politicians’ brand-new tax obligation cuts and costs expense.

A little bit much more unanticipated? Podcasters and social networks influencers will certainly likewise be omitted from handing over a section of their pointers, according to the list launched Tuesday by the Treasury Division.

The stipulation in the regulation authorized by Head of state Donald Trump in July removes government revenue tax obligations on pointers for individuals operating in tasks that have actually typically gotten them. It’s short-lived and ranges from 2025 up until 2028. It relates to individuals that earn less than $160,000 in 2025.

The Yale Budget plan Laboratory approximates that there were roughly 4 million workers in tipped professions in 2023, which totals up to about 2.5% of all tasks.

The management was needed to release a listing of certifying professions within 90 days of the expense’s finalizing. The full list of occupations lies on the Treasury Division internet site.

They are damaged down right into 8 groups, consisting of drink and food solution; enjoyment and occasions; friendliness and visitor solutions; home solutions; individual solutions; individual look and health; entertainment and guideline; and transport and shipment.

To name a few tasks excused from tax obligation on pointers are sommeliers, alcoholic drink waitress, bread cooks, cake bakers, bingo employees, club professional dancers, DJs, clowns, banners, on-line video clip designers, ushers, housemaids, garden enthusiasts, electrical contractors, cleaner, tow vehicle chauffeurs, wedding event coordinators, individual treatment assistants, tutors, au sets, massage therapy specialists, yoga exercise trainers, cobblers, skydiving pilots, ski trainers, parking lot assistants, shipment chauffeurs and moving companies.

A record from the Budget plan Laboratory reveals that the impacts of the regulation would certainly be little, considered that tipped employees have a tendency to be reduced revenue. Greater than 37% of tipped employees, or over one 3rd, made revenue reduced sufficient that they dealt with no government revenue tax obligation in 2022.

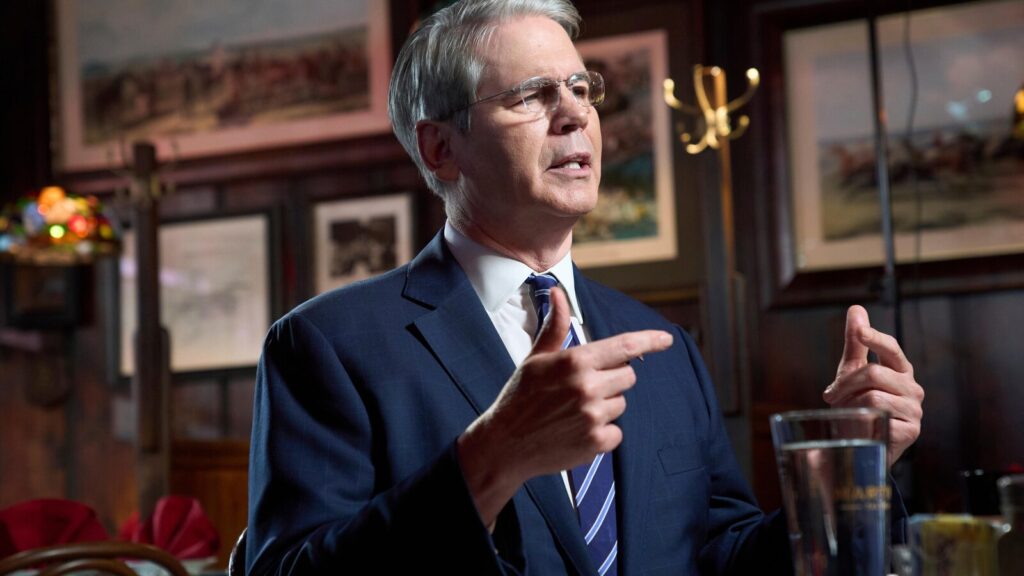

” The bigger and even more unclear result would certainly originate from behavior modifications incentivized by the expense, such as replacement right into tipped work and tipped revenue, which would certainly raise the expense’s total price,” specifies the record, which was created by Ernie Tedeschi, the supervisor of business economics at the Budget plan Laboratory.

Legislative budget plan experts forecast the “No Tax obligation on Tips” stipulation would certainly raise the shortage by $40 billion via 2028. The detached Joint Board on Tax estimated in June that the pointers reduction will certainly set you back $32 billion over one decade.

Just pointers reported to the company and kept in mind on an employee’s W-2, their end-of-year tax obligation recap, will certainly certify. Pay-roll tax obligations, which spend for Social Safety and security and Medicare, would certainly still be gathered together with state and neighborhood tax obligations.

Ballot reveals Americans have actually panned the huge expense. Half united state grownups anticipate the brand-new tax obligation regulation will certainly aid the abundant, according to the survey fromThe Associated Press-NORC Center for Public Affairs Research Many– concerning 6 in 10– assume it will certainly do even more to harm than aid low-income individuals.