Oregon can end up being the 2nd U.S. state to call for electrical car proprietors to sign up in a pay-per-mile program as legislators start an unique session Friday to load a $300 million transport spending plan opening that intimidates fundamental solutions like snowplowing and roadway repair services.

Lawmakers fell short previously this year to accept a transport financing plan. Thousands of state employees’ tasks are in limbo, and the proposition for a road usage charge for EV motorists was left on the table.

Hawaii in 2023 was the initial state to produce an obligatory roadway use fee program to offset predicted declines in gas tax obligation profits as a result of the expanding variety of electrical, hybrid and fuel-efficient automobiles. Lots of various other states have actually researched the principle, and Oregon, Utah and Virginia have volunteer programs.

The principle has assurance as a lasting financing service, specialists claim. Others stress over personal privacy problems and preventing individuals from getting EVs, which can help in reducing transport exhausts.

” This is a rather significant modification,” claimed Liz Farmer, an expert for The Seat Philanthropic Depends on’ state financial plan group, keeping in mind “the obstacle in establishing something that’s considerably various for many motorists.”

Oregon’s transport division states the spending plan deficiency comes from rising cost of living, predicted decreases in gas tax obligation profits and various other costs limitations. Over the summer season, it sent out discharge notifications to virtually 500 employees and revealed strategies to shut a lots roadway upkeep terminals.

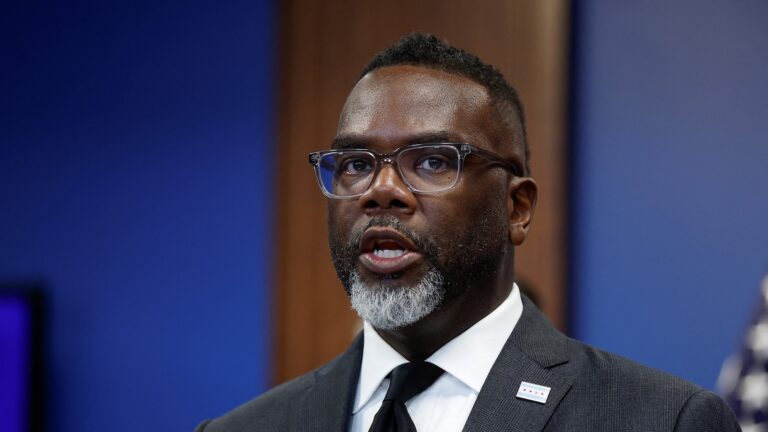

Autonomous Gov. Tina Kotek stopped those actions and called the unique session to locate a remedy. Republican legislators claim the division mishandling its cash is a major concern.

Kotek’s proposition consists of an EV roadway use fee that amounts 5% of the state’s gas tax obligation. It likewise consists of increasing the gas tax obligation by 6 cents to 46 cents per gallon, to name a few charge rises.

The use fee would certainly phase in beginning in 2027 for sure EVs and broaden to consist of crossbreeds in 2028. Need to the gas tax obligation rise be authorized, EV motorists either would certainly pay concerning 2.3 cents per mile, or select a yearly level charge of $340. Vehicle drivers in the program would not need to pay supplementary enrollment costs.

Drivers would certainly have numerous choices for reporting gas mileage to personal specialists, consisting of a smart device application or the car’s telematics modern technology, claimed Scott Boardman, plan advisor for the transport division that services the state’s decade-old volunteer roadway use fee program.

Since May, there mored than 84,000 EVs signed up in Oregon, concerning 2% of the state’s complete automobiles, he claimed.

Under Hawaii’s program, which started phasing in last month, EV motorists can pay $8 per 1,000 miles driven, covered at $50, or a yearly charge of $50.

In 2028, all EV motorists will certainly be called for to sign up in the pay-per-mile program, with odometers reviewed at yearly evaluations. By 2033, the program is anticipated to broaden to all light-duty automobiles.

In previous studies appointed by Oregon’s transport division, participants mentioned personal privacy, general practitioner gadgets and information safety as problems concerning roadway use fees.

Oregon’s volunteer program has actually looked for to react to such problems by erasing gas mileage information 1 month after a repayment is obtained, Boardman claimed. While plug-in GPS gadgets are a choice in the program, transport authorities prepare for relocating far from them due to the fact that they’re much more costly and can be gotten rid of, he included.

Still, not every person has actually welcomed a roadway use fee. Arizona citizens will certainly determine following year whether to prohibit state and city governments from executing a tax obligation or charge based upon miles took a trip after the action was described the tally by the Republican-majority Legislature.

Lots of people do not understand that “both your car and your cellular phone capture tremendous quantities of information concerning your individual driving routines currently,” claimed Brett Morgan, Oregon transport plan supervisor for the not-for-profit Environment Solutions.

Morgan included that roadway use fees surpassing what motorists of inner burning engines would certainly pay in gas tax obligations can deter individuals from getting electrical and hybrid automobiles. Currently, government tax obligation motivations for EVs are readied to end under the tax and spending cut bill just recently gone by the GOP-controlled Congress.

” We are most definitely encouraging of a roadway use fee that has EVs paying their reasonable share, yet they must not be paying added or a fine,” Morgan claimed.