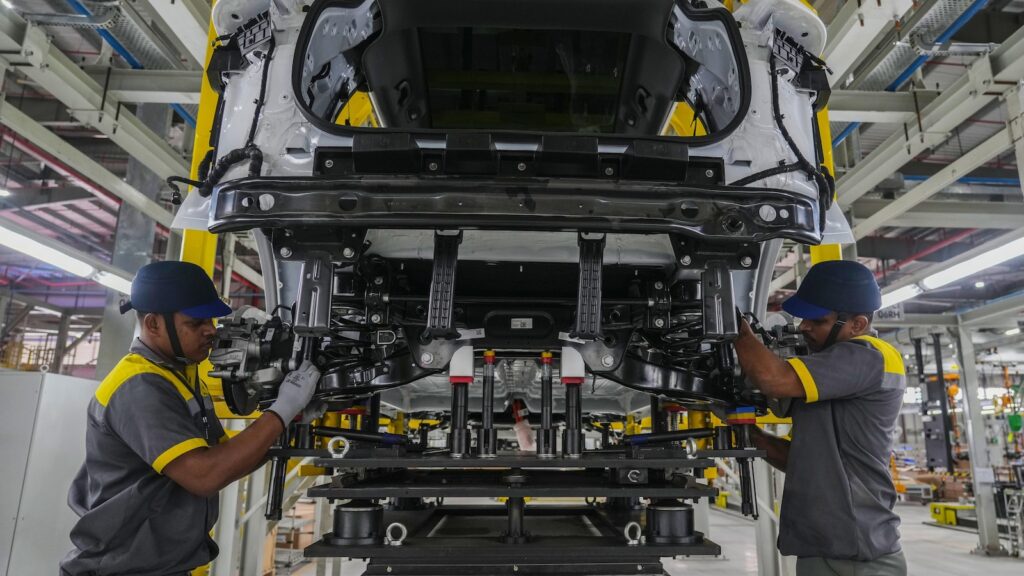

THOOTHUKUDI, India– Vietnam’s Vinfast results from begin Monday on a $500 million electrical car plant in southerly India’s Tamil Nadu state, component of an intended $2 billion financial investment in India and a wider development throughout Asia.

The manufacturing facility in Thoothukudi will at first make 50,000 electrical lorries each year, with space to three-way outcome to 150,000 autos. Provided its closeness to a significant port in among India’s many industrialized states, Vinfast wishes it will certainly be a center for future exports to the area. It claims the manufacturing facility will certainly develop greater than 3,000 neighborhood tasks.

The Vietnamese firm claims it looked 15 areas throughout 6 Indian states prior to selecting Tamil Nadu. It’s the facility of India’s car market, with solid production, experienced employees, great facilities, and a reputable supply chain, according to Tamil Nadu’s Industries Preacher T.R.B. Raaja.

” This financial investment will certainly cause a totally brand-new commercial collection in south Tamil Nadu, and a lot more collections is what India requires to become a worldwide production center,” he stated.

Vinfast’s venture right into India shows a wider change in technique.

The firm progressively is concentrating on Oriental markets after having a hard time to get grip in the united state and Europe. It began in 2014 on a $200 million EV setting up plant in Indonesia, where it intends to make 50,000 autos each year. It’s additionally broadening in Thailand and the Philippines.

Vinfast offered virtually 97,000 lorries in 2024. That’s three-way what it offered the year prior to, however just concerning 10% of those sales were outdoors Vietnam. As it considers markets in Asia, it wishes the manufacturing facility in India will certainly be a base for exports to South Oriental nations like Nepal and Sri Lanka and additionally to nations between East and Africa.

India is the globe’s third-largest cars and truck market by variety of lorries offered. It provides a luring mix: A rapid expanding economic climate, climbing fostering of EVs, helpful federal government plans and an unusual market where gamers have yet to totally control EV sales.

” It is a market that no car manufacturer worldwide can overlook,” stated Ishan Raghav, handling editor of the Indian cars and truck publication autoX.

EV development in India has actually been led by 2 and three-wheelers that represented 86% of the more than 6 million EVs offered in 2014.

Sales of 4 wheel traveler EVs composed just 2.5% of all cars and truck sales in India in 2014, however they have actually been rising, leaping to greater than 110,000 in 2024 from simply 1,841 in 2019. The federal government intends to have EVs represent a 3rd of all traveler car sales by 2030.

” The electrical cars and truck tale has actually begun (in India) just 3 or 4 years earlier,” stated Charith Konda, a power professional that checks out India’s transportation and tidy power industries for the think-tank Institute for Power Business Economics and Financial Evaluation or IEEFA. New autos that “look wonderful when driving,” with much better batteries, fast charging and longer driving varieties are driving the field’s fast development, he stated.

The change to EVs is mainly powered by Indian car manufacturers, however Vinfast intends to get into the marketplace later on this year with its VF6 and VF7 SUV versions, which are created for India.

Chinese EV brand names that control in nations like Thailand and Brazil have actually located India a lot more tough.

After boundary encounter China in 2020, India obstructed business like BYD from developing their very own manufacturing facilities. Some after that transformed to collaborations. China’s SAIC, proprietor of MG Electric motor, has actually accompanied India’s JSW Team. Their MG Windsor, a five-seater, offered 30,000 systems in simply 9 months, munching Tata Motors’ 70% EV market share to concerning 50%.

Tata was the initial neighborhood car manufacturer to court mass-market customers with EVs. Its 2020 launch of the electrical Nexon, a little SUV, came to be India’s initial significant EV cars and truck success.

Vinfast does not have the geopolitical luggage of its bigger Chinese competitors and will certainly additionally gain from rewards like reduced land costs and tax obligation breaks for developing in your area in India. That becomes part of India’s plan of inhibiting imports with high import responsibilities to aid motivate neighborhood production and develop even more tasks.

The promote onshore production is an issue additionally for Tesla, which launched its Model Y in India last month at a cost of virtually $80,000, contrasted to concerning $44,990 in the U.S without a government tax obligation credit report.

” India’s stand is extremely clear. We do not wish to import manufactured autos, also Teslas. Whether it’s Tesla or Chinese autos, they are strained greatly,” included Konda.

The roadway in advance stays difficult. India’s EV market is crowded with well-entrenched gamers like Tata Motors and Mahindra, which control the even more economical section, while Hyundai, MG Motors and deluxe brand names like Mercedes-Benz and Audi contend at high rate factors.

Indians often tend to buy EVs as 2nd autos made use of for driving within the city because the facilities for billing in other places can be undependable. Vinfast will certainly require to gain India’s cost-sensitive and traditional vehicle drivers with an online reputation for top quality batteries and solutions while maintaining costs reduced, stated Vivek Gulia, founder of JMK Study.

” Originally, individuals will certainly fear,” he stated.

Vinfast claims it intends to establish display rooms and solution facilities throughout India, collaborating with neighborhood business for billing and fixings, and reducing prices by reusing batteries and making crucial components like powertrains and battery cram in the nation.

Range will certainly be crucial. VinFast has actually authorized arrangements to develop 32 car dealerships throughout 27 Indian cities. Hyundai has 1,300 locations for Indians to acquire their autos. Constructing a brand name in India takes some time– Hyundai, for example, drew it off over years, assisted by a very early recommendation from Bollywood super star Shah Rukh Khan.

VinFast can do well if it can obtain its prices right and make the trust fund of consumers, Gulia stated, “After that they can really do actually great.”

___

Sibi Arasu added from Bengaluru and Aniruddha Ghosal added from Hanoi, Vietnam.

___

The Associated Press’ environment and ecological insurance coverage obtains financial backing from several exclusive structures. AP is only in charge of all web content. Discover AP’s criteria for collaborating with philanthropies, a checklist of advocates and moneyed insurance coverage locations at AP.org.