Bonita Anderson’s favored component of living in Baltimore is having household close by. A household matriarch with 5 youngsters and 8 grandchildren, Anderson strove to purchase an area in the city for her household to call home in 2009.

” It was an achievement for me,” she stated. “That’s where we made use of to collect to bring the household with each other.”

Recently, what was when Anderson’s treasured home was noted to buy at almost $540,000– greater than 5 times what she spent for it. Yet Anderson will not see any one of the earnings.

After greater than a years of paying towards her $100,000 home mortgage, Anderson was identified with cancer cells in 2020. Amidst installing clinical expenses and real estate tax, the long-lasting Baltimore citizen claims she needed to select in between defending her life and defending her home.

While undertaking therapy, Anderson fell back on her real estate tax by around $5,000. In 2022, she shed her home at a Baltimore City tax obligation sale.

” I took a seat and believed, ‘Oh my god, I’m 70 years of ages and I’m homeless,'” Anderson informed ABC Information Senior citizen Political Reporter Rachel Scott.

The City of Baltimore had actually placed a lien on Anderson’s tax obligation financial obligation and auctioned it off to the greatest prospective buyer– a business that concentrates on tax obligation lien acquisitions– for simply $69,500.

Bonita Anderson made use of to reside in this home in Baltimore.

ABC Information

” If you can not pay for to pay your real estate tax and you maintain missing your repayments, federal government is mosting likely to auction your residential property off for back tax obligations,” stated Lawrence Levy, executive dean at the National Facility for Suburban Researches at Hofstra College.

Court documents reveal Anderson attempted to make great and retrieve her home, paying the city $18,900 by the end of 2022– greater than three-way her superior tax obligations. Yet rather than placing these repayments towards her back tax obligations, the city used the cash to tax obligations that had actually built up under the brand-new proprietor.

Anderson was unwittingly paying the capitalist’s tax obligation expenses rather than her very own, enabling the firm to confiscate on her home in 2023.

” I was simply frustrated,” she stated.

‘ Loaded with distortions’

Anderson’s home was simply among almost 44,000 Baltimore residential properties that were noted at community tax obligation sales from 2019 via 2023. It was additionally amongst the 92% of those residential properties situated in majority-nonwhite communities– which make up 70% of parcels citywide.

An evaluation of ATTOM and united state Demographics Bureau information by ABC Owned Tv Stations revealed one most likely factor for this difference: out of proportion real estate tax.

Real estate tax are based upon a federal government analysis of each home’s worth. Yet scientists claim residential property worths are very subjective, and these price quotes do not constantly straighten with market value.

Information reveals disparities in analyses– and consequently tax obligation expenses– impact some neighborhoods greater than others.

ABC’s evaluation located that throughout the nation, house owners in mostly Black and Brownish locations have a tendency to pay greater tax obligations than those in primarily white communities for a home worth the very same quantity on the free market.

” When real estate tax systems are full of distortions individuals penalized have a tendency to be the poorest house owners,” Levy stated. “In suburb, where you have a high degree of partition, individuals that are being strained unjustly based upon not properly catching the worth of the home are individuals of shade.”

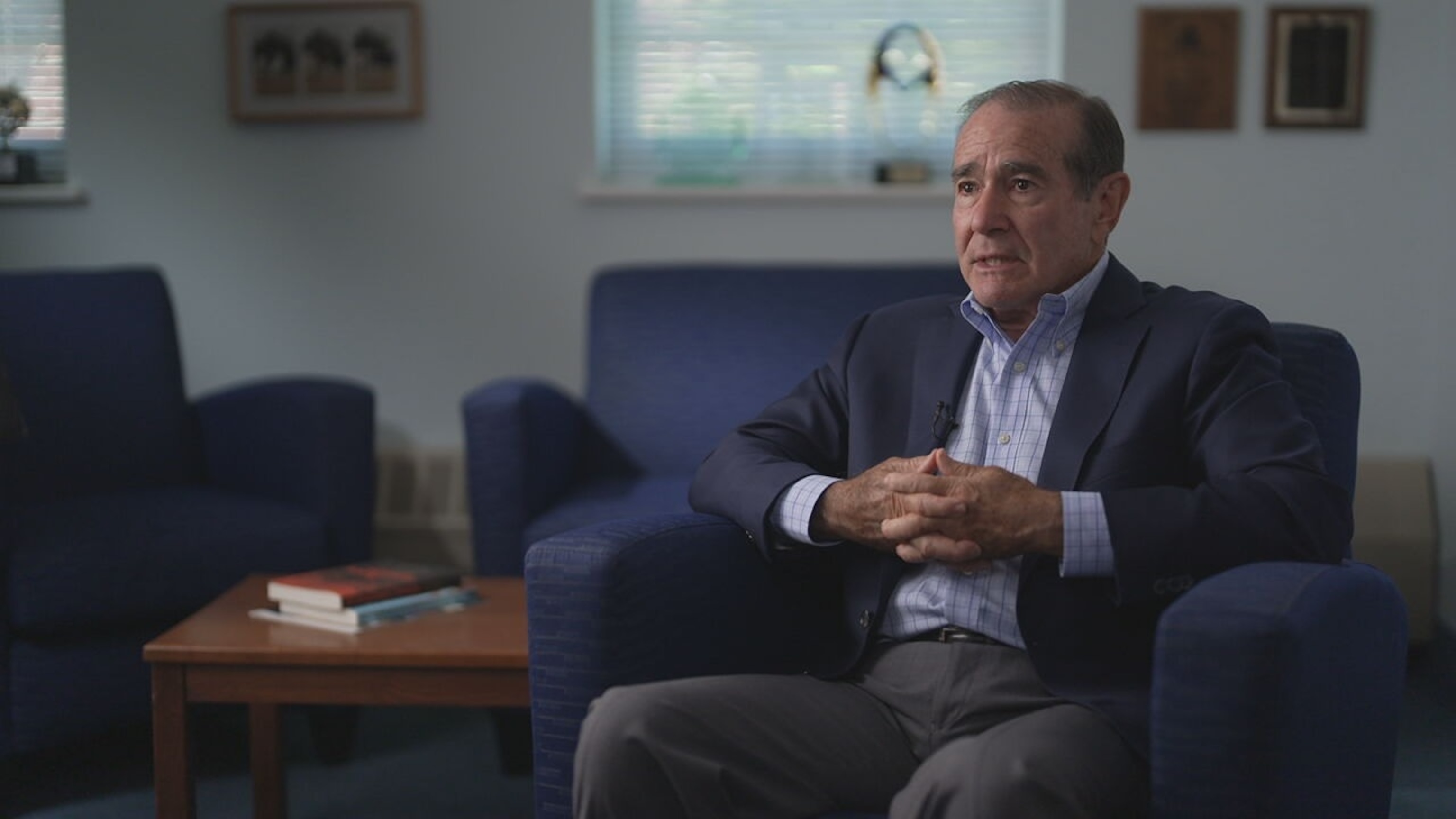

Lawrence Levy is the exec dean at the National Facility for Suburban Researches at Hofstra College on New york city’s Long Island.

ABC Information

For a few of these house owners that are “highballed” on their analyses, missed out on expenses cause tax obligation sales, leaving them with absolutely nothing. From the moment Anderson purchased her home till she shed it, the residential property’s analysis greater than tripled– however the home’s thriving worth inevitably mosted likely to its brand-new proprietor.

” I do not understand what’s even worse, shedding your house or being identified with cancer cells,” Anderson stated. “It injures still.”

Till lately, Levy kept in mind, tax obligation sales frequently happened in cities. As metropolitan communities gentrified and residential property worths changed quickly, long time locals could not constantly stay on top of climbing expenses.

” We’re currently beginning to see even more of that in suburbs, specifically in the poorer suburbs as we’re seeing market adjustment,” Levy stated.

In Yard City, a primarily white suburban area on New york city’s Long Island with an average home worth of around $1 million, a common domestic tax obligation costs is around $10,000 to $15,000, residential property information programs.

In the future in Hempstead, where 88% of locals are Black or Latino, homes have a tendency to be worth much less than fifty percent that. Yet the regular tax obligation costs is comparable, indicating Hempstead house owners pay proportionally much more in tax obligations about the worth of their homes.

John Rao, elderly lawyer at the National Customer Regulation Facility, claims united state house owners in neighborhoods of shade deal with a “dual whammy.” They frequently get “lowballed” appraisals when attempting to acquire or re-finance their homes, Rao discussed, “however when it involves paying their tax obligations, when they have actually had the home … frequently their analyses are proportionally more than what they ought to be.”

‘ Removing generational wide range’

In country Delaware Region, Pennsylvania, 91-year-old Gloria Gaynor, that deals with mental deterioration, shed her home of 25 years as a result of $3,500 in tax obligations she really did not pay throughout the COVID-19 pandemic.

Gaynor’s child, Jackie Davis, told ABC station WPVI-TV that her mommy stayed at home throughout the pandemic. She missed her yearly journey to the tax obligation workplace after listening to that tax obligation collection agencies had actually stopped enforcement as COVID-19 spread via the Philly residential areas.

When the federal government reactivated collection initiatives and the area tax obligation workplace resumed, Gaynor entered and made a settlement, meaning to cover her previous year’s tax obligations, according to her lawyer, Alexander Barth.

Rather, the cash was related to Gaynor’s 2021 and 2022 tax obligations and not her superior equilibrium from 2020, “leaving what is basically a donut in her tax obligation repayment background,” Barth discussed.

Jackie Davis is seen taking care of her 91-year-old mommy, Gloria Gaynor.

WPVI

An investor purchased Gaynor’s home from Delaware Region for $14,000, the price of her past due tax obligations plus passion and costs.

Gaynor had actually settled a lot of her home mortgage on the home, which is currently worth an approximated $247,000. Yet she did not make any kind of cash from the sale.

” This is removing generational wide range from the have-nots and enabling the riches to have it,” Barth stated.

Gaynor’s household litigated in an effort to come back her home, however 2 courts maintained the sale.

The Delaware Region Tax obligation Case Bureau informed ABC’s Philly terminal that while it “offers consolation with the psychological toll” on Gaynor, the area federal government acted within Pennsylvania legislation and provided numerous notifications in advance of the sale.

If Gaynor had actually lived simply a couple of miles away inside Philly’s city limitations, authorities there would certainly have taken added actions to attempt to maintain her in her home.

Because real estate tax are taken care of in different ways in various neighborhoods, some city governments like Philly have layers of defense for at risk house owners, such as needing in-person alerts prior to a tax obligation sale or offering repayment prepares to retrieve a home later.

” Although city governments ought to do every little thing they can to maintain individuals in their homes, whether it’s a proprietor or a tenant, eventually they have a commitment to all the various other taxpayers, business, the households that are paying their reasonable share to ensure that these tax obligations are accumulated,” Levy stated.

From the living-room to the court room

Simply over 90 miles later on from Gaynor, Anderson invests her days reviewing the memories she integrated in the home that was when the focal point of her household.

Currently dealing with her child in a Baltimore suburban area, Anderson has actually taken her situation to court, signing up with a claim declaring that the City of Baltimore damaged government legislation by marketing her previous home to an exclusive firm for dimes on the buck.

The City of Baltimore, which did not react to ABC Information’ ask for remark, has actually safeguarded its activities in court, stating it alerted Anderson as called for and did not make money from the sale.

In 2023, the united state High court ruled that city governments might not make money from tax obligation sales, locating that house owners have a constitutional right to any kind of repayments past the tax obligations and fines they owe.

Over the last 2 years, numerous states throughout the nation have actually altered their regulations due to the court’s choice. Yet some specialists claim the federal government additionally has a duty to play.

Bonita Anderson (left) informed ABC Information Senior citizen Political Reporter Rachel Scott that she was “frustrated” by the loss of her Baltimore home.

ABC Information

” The government response to reduced regional real estate tax is much more moneying for regional solutions,” Levy stated. “They require even more aid from Congress and the White Residence.”

As the Trump management has actually lowered the government spending plan, city governments will certainly need to compose the distinction to give the very same solutions.

According to specialists, districts will likely count much more on real estate tax, which subsequently, might suggest even more scenarios like Anderson’s, where house owners in majority-nonwhite communities frequently pay greater than their reasonable share.

When asked by ABC Information what occurred to her desire for giving her home to the future generation of her household, Anderson stated, “it passed away.”

” It still makes me psychological,” Anderson stated. “It’s simply hard. Extremely hard.”

ABC Information’ Meghan Mistry, John Santucci and Lucien Bruggeman together with ABC Owned Tv Stations’ Ryann Jones, Maggie Environment-friendly, Jason Knowles, Cheryl Mettendorf, Chad Pradelli, Dan Krauth, David Paredes, Ross Weidner and Sarah Rafique added to this record.