A tasks report readied to be launched on Friday will certainly supply the current scale of united state financial health and wellness as Head of state Donald Trump’s tolls improve the country’s profession partnerships.

The fresh hiring information shows up days after a federal government record revealed better-than-expected financial development. UNITED STATE GDP boosted at a 3% annualized price over 3 months finishing in June, the record claimed.

The durable analysis recommended the economic situation has actually remained to avoid a substantial tariff-induced cooldown. A one-off analytical peculiarity connected to a drop-off of imports showed up to partly make up the rise, nevertheless.

Economic experts anticipate the united state to have actually included 100,000 tasks in July, which would certainly note a strong gain however a stagnation from 147,000 tasks included the previous month. The awaited efficiency would certainly can be found in listed below a month-to-month standard of 130,000 tasks included until now this year.

Secret actions of the economic situation have actually confirmed durable in current months, resisting worries of resurgent rising cost of living and a feasible financial slump. Hiring has actually maintained a strong, albeit slower speed, humming in addition to much less disturbance than some financial experts expected. Rising cost of living has actually boosted for 2 successive months however it stays well listed below a peak acquired in June 2022.

The task record shows up days after the Federal Book decided to hold rate of interest stable at its July conference.

5 conferences and 7 months have actually expired given that the Fed last modified rate of interest. The government funds price separates 4.25% and 4.5%, maintaining a lot of a sharp rise enforced in reaction to a pandemic-era spell of rising cost of living.

Theoretically, durable financial development reduces stress on the Fed to decrease rate of interest, given that customers and services show up undeterred by high loaning expenses. A significant stagnation in the labor market, on the other hand, can trigger the Fed to provide better factor to consider to a possible price cut.

Head Of State Donald Trump has actually consistently prompted the reserve bank to reduced rate of interest, claiming the plan would certainly enhance financial efficiency and decrease passion settlements on national debt.

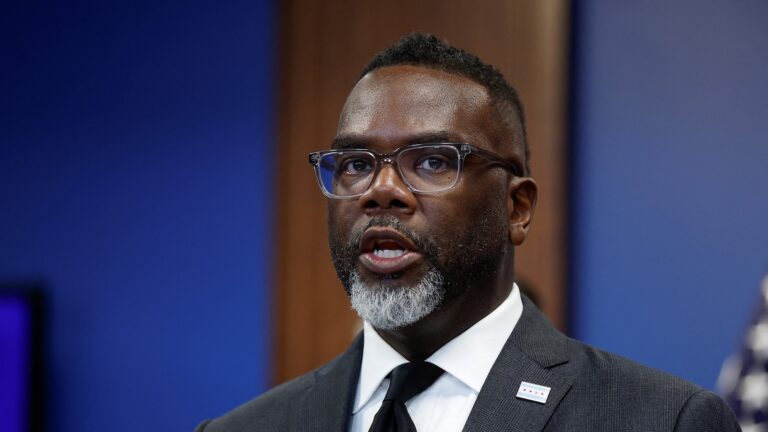

Federal Book Chairman Jerome Powell speaks to press reporters complying with the normal Federal Free market Board conferences at the Fed on July 30, 2025 in Washington, DC.

Chip Somodevilla/Getty Pictures

Fed Chair Jerome Powell, by comparison, has actually articulated some worry regarding a reviving of rising cost of living because of raised tolls. Importers commonly pass along a share of the greater tax obligation problem in the type of cost walks.

Talking at an interview in Washington, D.C., on Wednesday, Powell claimed tolls had actually started to add to cost rises for some products however the supreme effect of the plan stays unsure.

” Greater tolls have actually started to reveal with even more plainly right into rates of some products however their general results on rising cost of living and the economic situation continue to be to be seen,” Powell claimed. “Their results on rising cost of living can show to be short-term, however it is feasible the rising cost of living results can be much more relentless.”

He included, “We’ll do what we require to do to maintain rising cost of living controlled.”