The Division of Education and learning has actually stopped the Revenue Based Settlement strategy (IBR) in an additional considerable relocation that changes the trainee lending settlement procedure for numerous Americans.

The IBR strategy terminates lending financial obligation completely for debtors that have actually made 300 regular monthly repayments– or regarding 25 years of repayments. Afterwards 25-year duration, the strategy terminates any type of impressive equilibriums and thinks about the debtors’ settlement commitment to be pleased. Trainee lending supporters inform ABC Information that debtors are still being billed when their trainee lending ought to currently be terminated under the strategy.

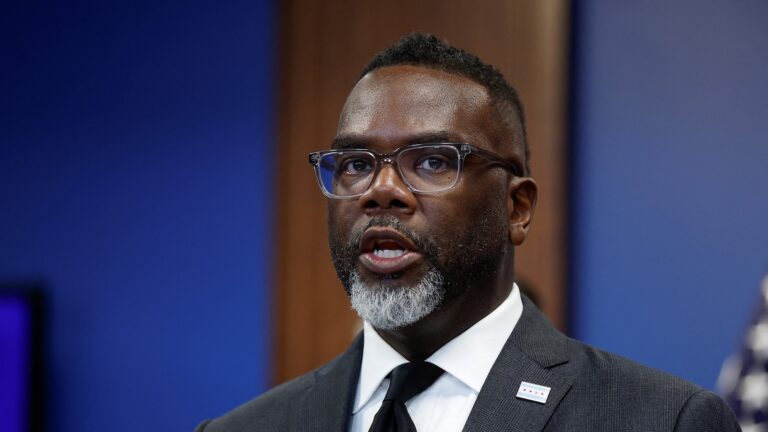

” Since today, if you have actually owed money for 25 years, you have a right under government legislation to obtain your financial obligation terminated, and the federal government is not recognizing that legislation,” Trainee Consumer Security Facility (SBPC) Exec Supervisor Mike Pierce stated.

This strategy was statutorily mandated under the College Act and urged by the Trump management’s Education and learning Division while the firm introduces its brand-new Settlement Aid Strategy. The current time out was not introduced yet is noted on a Frequently Asked Questions page of the Federal Trainee Help website. It is currently triggering concern and complication for debtors that have actually been left at night, according to trainee lending specialists.

Pierce stated the federal government put on hold the mercy prepare for factors that the management hasn’t discussed.

” We do not recognize the amount of individuals are influenced by it, we do not recognize the amount of individuals will certainly be influenced by it in the future, we do not recognize why it’s occurring,” Pierce informed ABC Information.

” We’re stressed that this is simply the Trump management determining that its judgment is more vital than the judgment of Congress, and it’s mosting likely to do whatever the heck it desires,” Pierce included.

ABC Information has actually connected to the Division of Education and learning for talk about the interaction of the IBR strategy time out.

The quad of the College of Illinois in Champaign.

Supply PHOTO/Getty Pictures

Under the current time out, IBR accounts are being investigated for the variety of certifying repayments it has actually obtained.

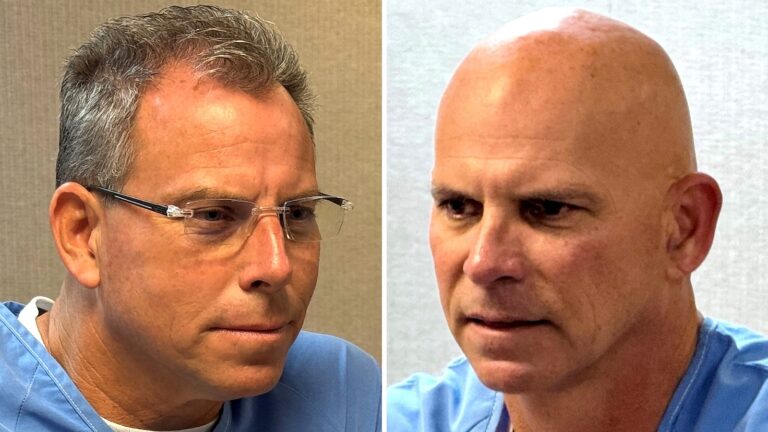

Abby Shafroth, taking care of supervisor of campaigning for at the National Customer Regulation Facility (NCLC), called the time out both shocking and worrying for debtors as lots of have actually satisfied the certifying variety of repayments, yet claim that they’re still obtaining billed.

” It has kind of silently appeared that [IBR is] still not providing individuals termination,” Shafroth informed ABC Information.

Shafroth explained the circumstance as a “mess.” She kept in mind the IBR strategy is the one program that the present Education and learning Division has actually urged debtors to enlist in, has actually stated will certainly give financial obligation mercy which Congress plainly developed and mandated.

” The Division of Education and learning truly needs to have this and repair it,” Shafroth stated.

” If they do not repair it, it’s both mosting likely to damage down count on and it’s mosting likely to set you back a great deal of individuals even more cash. I do not recognize the amount of individuals, yet it’s mosting likely to set you back individuals even more cash,” she stated.

According to Shafroth, debtors will certainly maintain obtaining billed on financial debts that they no more owe and, consequently, they can wind up needing to pay big tax obligation costs in their 2026 tax obligation year.

In this Sept. 23, 2020, data picture, the Division of Education and learning structure is received Washington, D.C.

Robert Knopes/UIG by means of Getty Images, DATA

IBR is among 4 Revenue Driven Settlement prepares that takes a portion of your revenue for regular monthly repayments, consisting of the Pay As You Gain (PAYE), Revenue Set Settlement and the Cost Savings on a Prized Possession Education And Learning or “CONSERVE” strategies. Consumers on the Biden-era conserve strategy– regarding 7.7 million individuals– will certainly have passion fees return on Aug. 1 at the exact same time the Education and learning Division stated it’s adhering to a government court order that obstructed application of the strategy.

The passion reactivate comes as Head of state Donald Trump just recently authorized right into legislation his trademark residential plan program, the One Big Beautiful Costs Act, that included a stipulation to end all present trainee lending settlement strategies– such as SAVE and various other IDRs– for car loans paid out on or after July 1, 2026. The strategies will certainly be changed with 2 different settlement strategies: a basic settlement strategy and the Settlement Aid Strategy, a brand-new income-based settlement strategy. Nevertheless, these settlement strategies are presently influenced by lawful obstacles, according to a launch from the division.

The Education and learning Division’s current trainee lending changes indicate the Trump management’s change far from previous Head of state Joe Biden’s financial obligation mercy strategies. The division will certainly develop a Reimagining and Improving Trainee Education And Learning (SURGE) Board to resolve its future modifications. Assistant of Education and learning Linda McMahon stated she wishes to streamline the extremely intricate system.

Unlike customer concerns, McMahon informed ABC Information her firm’s reforms aren’t implied to be “corrective” neither does she wish to see debtors back-pedaling car loans.

” When you remain in default on a car loan, you can not purchase a residence, you can not purchase a vehicle, so call [the department],” McMahon stated, including, “Simply make certain that you get on the appropriate settlement strategy.”

” Be aggressive and return right into among the layaway plan,” she stated.

At the same time, Shafroth stated this time out in the IBR strategy possibly makes debtors extra distrustful and, consequently, additional separates the customer and the federal government.

” It truly pushes away debtors, and they quit relying on the federal government and quit, sometimes, paying back, or, you recognize, being receptive on their car loans,” she stated.

SBPC’s Pierce cautioned this is a lawful issue that debtors are qualified to having actually settled.

” Individuals with trainee car loans do still have legal rights under the legislation, consisting of the right to obtain their financial obligation terminated,” Pierce informed ABC Information.

” It is essential for debtors to recognize that the Trump management can not desire that away.”