Head Of State Donald Trump today claimed he had actually talked about with a team of Republican legislators the opportunity of shooting Federal Book Chair Jerome Powell, prior to strolling back such strategies, calling them “extremely not likely.”

Still, the episode sent out supply rates rolling and bond returns climbing up, till Trump’s disavowal recovered tranquil to the marketplaces.

In an uncommon public rebuke of Trump, a number of big-bank Chief executive officers worried the value of an independent reserve bank.

” I believe the self-reliance of the Fed is definitely essential,” JPMorgan Chase chief executive officer Jamie Dimon claimed on a revenues contact Wednesday.

Main lenders beholden to politicians often tend to prefer reduced rates of interest as a way of enhancing temporary financial task, reducing joblessness and creating public assistance, experts informed ABC Information. However, they included, that position positions a significant danger in the opportunity of years-long rising cost of living sustained by a surge in customer need, untethered by rates of interest.

” It’s now commonly concurred, nearly all over the globe: If you leave financial plan in political hands, you’ll obtain excessive rising cost of living,” Alan Blinder, a teacher of business economics at Princeton College and previous vice chairman of the Federal Book, informed ABC Information.

” There’s lure to provide the economic situation juice in the brief run,” Binder included. “The prices in regards to high rising cost of living come later on.”

Considering that Trump took workplace, he has actually consistently advised the Fed to reduce rates of interest in an initiative to reinforce the economic situation.

” We have a male that simply rejects to reduce the Fed price,” Trump claimed of Powell last month. “Perhaps I must most likely to the Fed. Am I enabled to select myself? I would certainly do a better task than these individuals.”

Talking at the Oval Workplace on Wednesday, Trump used a various factor for the Fed to reduce prices, stating it would certainly decrease united state debt-service repayments, conserving “trillions of bucks in rate of interest expense.”

Trump additionally knocked Powell for claimed overspending linked to the reserve bank’s $2.5 billion structure restoration task. The Fed connects investing overruns to unpredicted boost, stating that its structure restoration will eventually “decrease prices with time by permitting the Board to combine a lot of its procedures,” according to the reserve bank’s website.

While economic experts differ over whether interest-rate cuts are presently required, the possibility of a politically endangered Fed intimidates to increase rising cost of living assumptions as capitalists are afraid a waterfall of price decreases and a resulting spike in rates, Wendy Edelberg, supervisor of the Hamilton Job and elderly other in financial research studies at the Brookings Establishment, informed ABC Information.

Extensive rising cost of living concerns would certainly verify detrimental, running the risk of high rates of interest since a prospective spell of high rising cost of living would certainly gnaw at the worth of financial debt repayments and call for bigger amounts to comprise the distinction, Edelberg claimed.

” If your uncle was providing you cash and he believed rising cost of living was mosting likely to be truly high over the following couple of years, your uncle would certainly request for a high rates of interest,” Edelberg claimed.

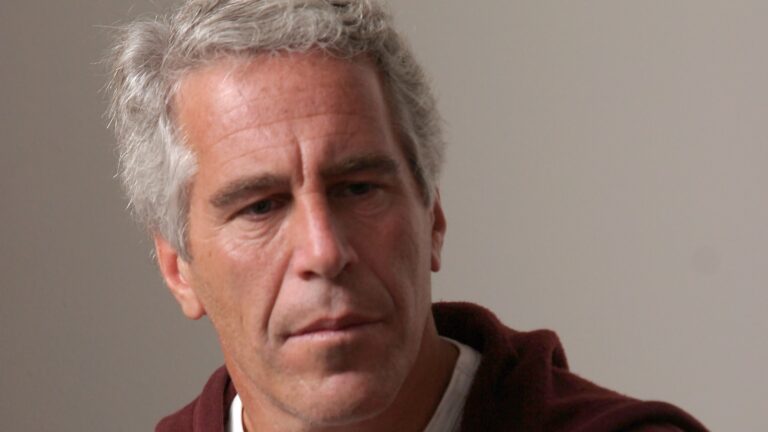

Head Of State Donald Trump and Federal Book Guv Jerome Powell at an election event at the White Home, Nov. 2, 2017.

Xinhua/Yin Bogu through Getty Picture

A ruptured of high rising cost of living in the 1970s and 1980s supplies a sign of things to come, some experts claimed.

Prior to the rising cost of living held, Head of state Richard Nixon had actually advised then-Fed Chair Arthur Burns to reduce prices in the run-up to the 1972 governmental political election. Nixon’s campaigning for is commonly deemed adding to lower-than-necessary rates of interest that enabled rising cost of living to leave control.

Virtually a years later on, in 1981, the Fed increased rates of interest as high as 20% in order to bring rising cost of living in control. While the relocation prospered in cooling down rate walkings, it dove the united state right into an economic downturn and sent out the joblessness price to 10%.

” If you’re simply consuming treat constantly, you truly do need to take your veggies,” Mark Spindel, primary financial investment policeman at Potomac River Funding and co-author of “The Misconception of Freedom: Just How Congress Controls the Federal Book,” informed ABC Information, concerning the requirement for monetary vigilance.

Though a politically endangered Fed threats financial instability, experts claimed, the reserve bank currently encounters guidance from chosen authorities in the type of twice-a-year Fed chair testament prior to Congress, and Us senate authorization for the Fed’s seven-member Board of Governors. Powell, whose term finishes in Might, was chosen by Trump in 2017 and chosen momentarily term by Head of state Biden.

Public analysis and federal government oversight assistance make sure the Fed offers the passions of the general public, Edelberg claimed.

” I’m never saying the Fed ought to be entrusted to its very own tools behind citadel wall surfaces,” Edelberg included.