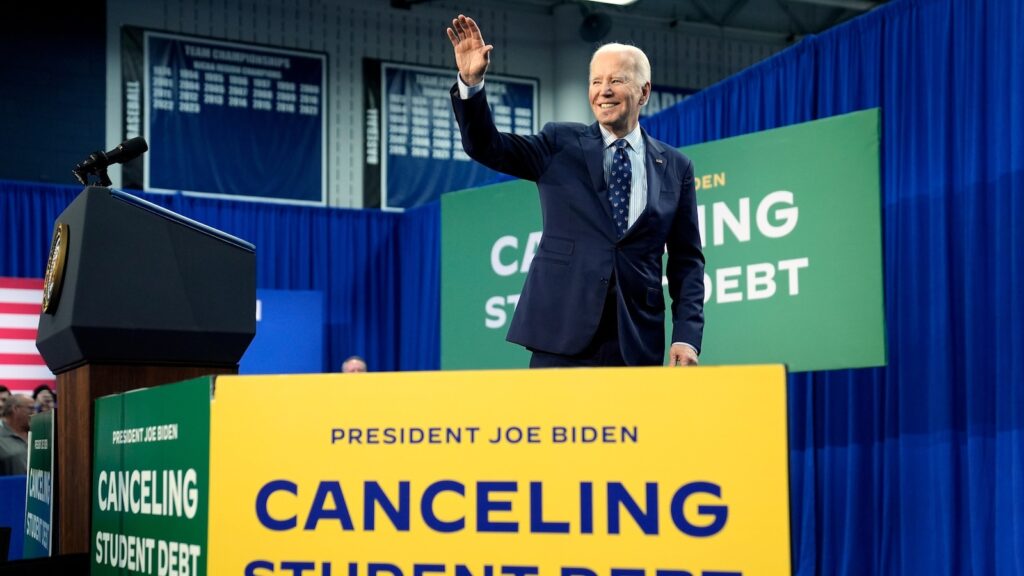

NEW YORK CITY– The Trump administration’s current modifications to trainee fundings are triggering irritation and complication for some consumers.

In action to a February court judgment that obstructed some Biden-era programs, the Education Department has actually removed online and paper applications for income-driven payment strategies.

” This specifically injures anybody that’s shed their tasks, consisting of government employees,” claimed Natalia Abrams, creator and head of state of the Trainee Financial Obligation Situation Facility. “A couple of months earlier, they would certainly have had the ability to hop on a zero-dollar income-driven payment strategy.”

The elimination of application products likewise has actually triggered complication around the recertification procedure for consumers currently registered in payment strategies, specialists claim. Income-driven payment strategies take a debtor’s funds and family members dimension right into account when determining month-to-month settlements, yet consumers have to regularly show they still certify.

Including in the unpredictability are layoffs at the Education Department, which supervises the government finance system. The government site for trainee fundings and financial assistance, StudentAid.gov, endured an hours-long outage Wednesday, yet the division has claimed it will certainly remain to provide on its dedications.

” It’s been wave after wave of trouble for trainee consumers,” claimed Aissa Canchola Bañez, plan supervisor at the Trainee Debtor Security Facility.

Right here’s some support for those with trainee fundings.

All consumers presently registered in income-driven payment strategies need to “obtain a feeling of when your recertification target date is and obtain a feeling of what alternatives are readily available to you if the kind is not readily available online to recertify your revenue,” Bañez claimed.

Recertification verifies a debtor’s economic circumstance. With some types not presently readily available, consumers that are incapable to finish that procedure might be at risk.

If consumers are currently on an income-driven payment strategy, they need to still be permitted to stay on that particular payment strategy if they have the ability to recertify their revenue.

Abrams claimed it’s likewise an excellent concept to take screenshots of your account’s existing standing on the trainee help site.

State-specific and state-level sources are readily available for trainee consumers. Congress participants have actually groups billed with assisting components if they are having problem with a government company or having a hard time to call a government trainee finance servicer.

Consumers might call their reps in Congress and open up a casework documents by going onto their site or calling their workplace.

” Attempt stating something like, ‘I require your aid to recognize just how to enter into a budget friendly payment alternative, which I’m qualified to under the regulation,'” Bañez claimed. “‘ Although this government division has actually removed these applications, I require your aid.'”

In spite of the thinning of the Education and learning Division and Head of state Donald Trump’s taking down of the Consumer Financial Protection Bureau, finance servicers still have to take into consideration a debtor’s economic circumstance, Bañez claimed.

” You can see if you can obtain short-lived forbearance or a deferment of settlements for economic challenge,” she claimed.

State attorney generals of the United States likewise take questions from trainee consumers.

Jessica Fugate, a federal government relationships supervisor for the city of Los Angeles, claimed she was a much less than a year from trainee finance mercy under the Biden-era Civil Service Car loan Mercy program, which forgives superior fundings after 120 settlements.

With a continuous court difficulty to her previous SAVE layaway plan, however, Fugate wanted to change to an income-driven strategy prior to Trump took workplace. She used in January.

” It’s one of the most economical alternative to settle my fundings while residing in Los Angeles benefiting the federal government on a federal government income,” claimed Fugate, 42. “And it would certainly indicate my settlements counted in the direction of mercy.”

Since February, Fugate informed that her application was obtained and she had actually been informed of its standing, yet they really did not claim when she would certainly recognize if she was accepted.

” And when I called lately, the maker claimed there was a 4 hour delay,” she claimed.

With income-driven payment strategies in limbo, Fugate isn’t certain what her alternatives are and intends to someday have her government fundings behind her.

” I have actually been benefiting federal government for nearly one decade. Afterwards much time, you do not do it for the splendor,” she claimed. “I have actually invested a lot of my profession returning to other individuals. I do not mind offering individuals. I simply feel this was a contract they made with the general public, therefore we’re owed that. And it’s a great deal of us. And we’re not simply numbers.”

Debbie Breen, 56, operates at a firm on healthy and balanced aging in Spokane, Washington. Breen claimed she has actually operated in the not-for-profit industry for greater than one decade which almost all those years counted towards Civil service Car Loan Mercy.

Breen likewise got on the Biden-era conserve strategy, which implies she was put in forbearance when the court difficulty to that strategy was supported. Like Fugate, she had actually prepared to change to an income-driven payment strategy to have her settlements count in the direction of mercy.

” I was months far from finishing this headache,” she claimed. “Currently I do not assume that’s mosting likely to occur. I’m sort of in panic setting since I recognize that if they quit income-driven payment strategies, I do not recognize that I’m mosting likely to have the ability to manage the settlements monthly.”

Breen claimed she has 2 children that likewise have trainee fundings.

” They’re managing the very same point,” she claimed. “It’s frightening. It’s definitely frightening.”

___

The Associated Press obtains assistance from Charles Schwab Structure for instructional and informative reporting to boost economic proficiency. The independent structure is different from Charles Schwab and Co. Inc. The AP is entirely in charge of its journalism.